Market Analysis Sep 25th 2023: Fed Postpones Rate Hike, Bitcoin Slightly Down at $27,000

In the previous week, the Federal Reserve opted to maintain its current interest rates. As a result, Bitcoin experienced a modest decline in value. However, there are indications that the Fed may raise interest rates before the year’s end. What implications might this hold, and how might Bitcoin respond? We delve into the analysis below.

The Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 🚨 The Fed decided to maintain interest rates in the range of 5.25% to 5.5%, but there’s potential to increase them before the end of 2023.

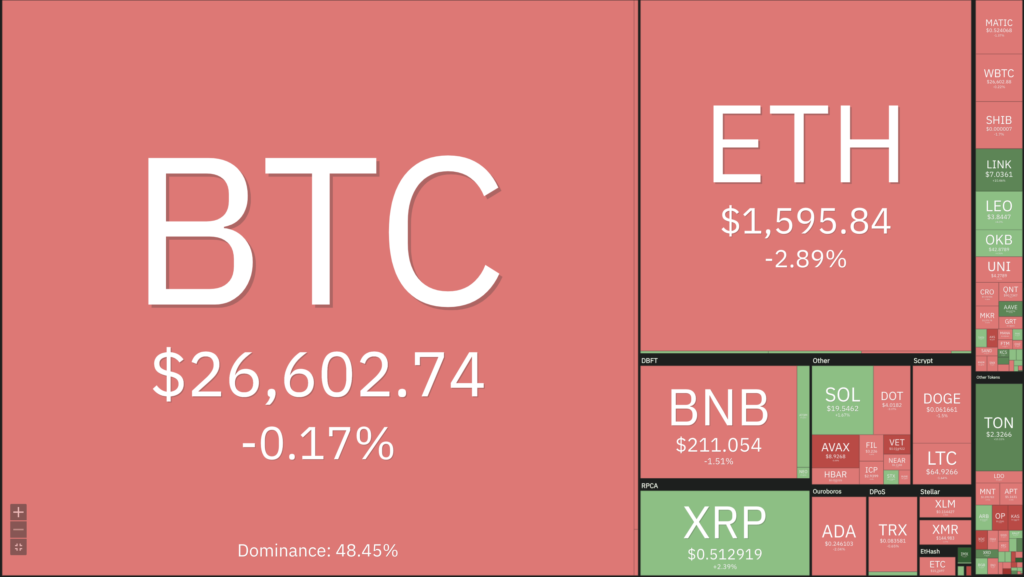

- ✍🏻 Following the Fed’s decision, Bitcoin experienced a drop below $27,000, with a resistance point at the 200-week Moving Average (MA). Meanwhile, Ethereum fell below $1,600 after failing to break through the resistance level.

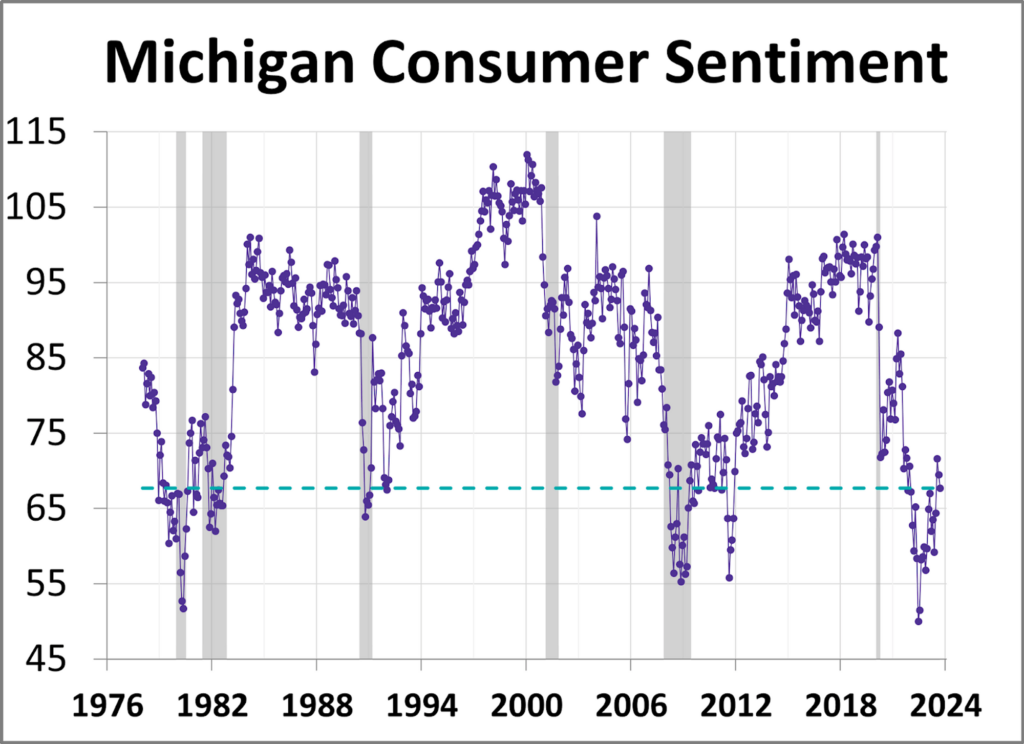

- 📉 Other macroeconomic data indicates that US consumer sentiment declined in September to 67.7, down from the August year-end figure of 69.5.

Macroeconomic Analysis

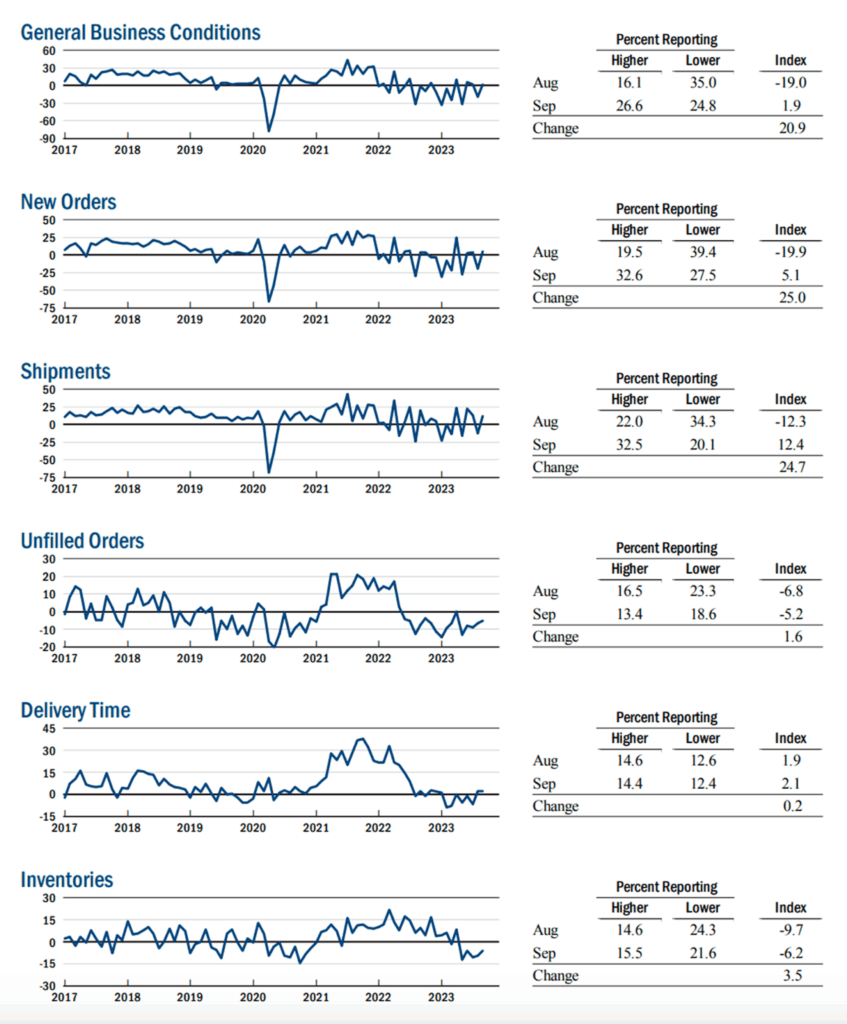

This week’s market analysis begins with a report on business activity in New York State and labor market indicators in the United States (US), according to the Empire State Manufacturing Survey for September 20-23, including:

- The main indicator for general business conditions has increased by 21 points, reaching 1.9.

- Both new orders and shipments experienced growth, while delivery times remained stable, and inventories continued to decline.

- The labor market showed a slight decrease in employment levels and average workdays.

Looking ahead, companies are more optimistic about the outlook for the next six months.

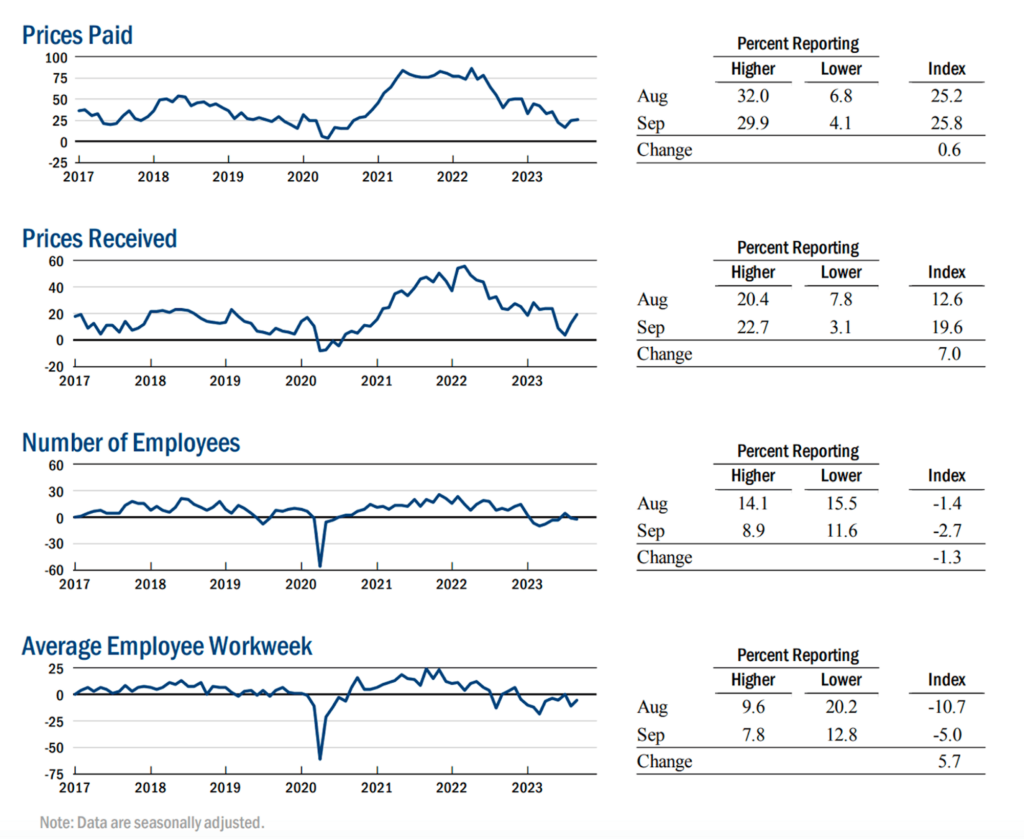

Despite the optimism, the employment index data recorded minus 2.7, indicating a decline in employment levels. Meanwhile, the average weekly working hours index rose slightly to -5.0, signaling a reduction in monthly working hours. However, the prices paid index remained stable at 25.8, indicating little fluctuation in the rate of input price increases. On the other hand, the prices received index rose by seven points to 19.6, indicating a slight acceleration in the rate of selling price increases.

The outlook for future business conditions, rose six points to 26.3, its highest level in the past year. This increase indicates that business leaders have positive expectations for future conditions, such as significant growth in new orders and shipments and expansion of employment opportunities. However, the opposite is true for the investment index, which fell to 10.3 and remains relatively weak.

Michigan Consumer Sentiment

From a consumer sentiment perspective, the Michigan Consumer Sentiment data showed a decline for the second consecutive month. According to preliminary data from the University of Michigan Consumer Sentiment Index, the index fell to 67.7 in September from the final reading of 69.5 in August. The reading was below the forecast of 69.1.

However, there was still a slight improvement in the economic outlook, driven by a decline in short-term inflation expectations to the lowest level in more than a year.

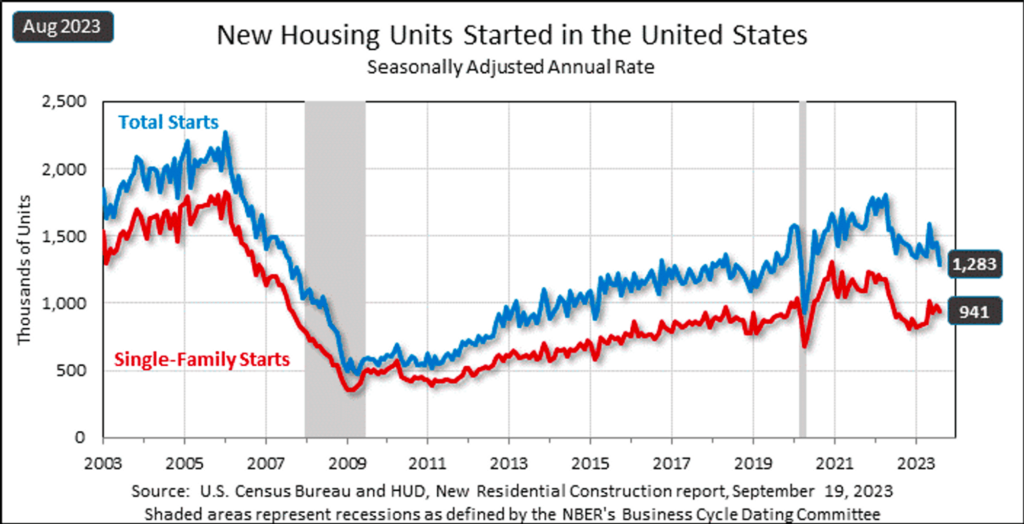

Building Permits

New housing starts in the U.S. also declined, falling 11.3% in August. Most of the decline was in multi-family construction.

In addition, single-family construction, which accounts for the majority of housing activity, fell 4.3% to a rate of 941,000 units last month.

Fed Interest Rate Decision

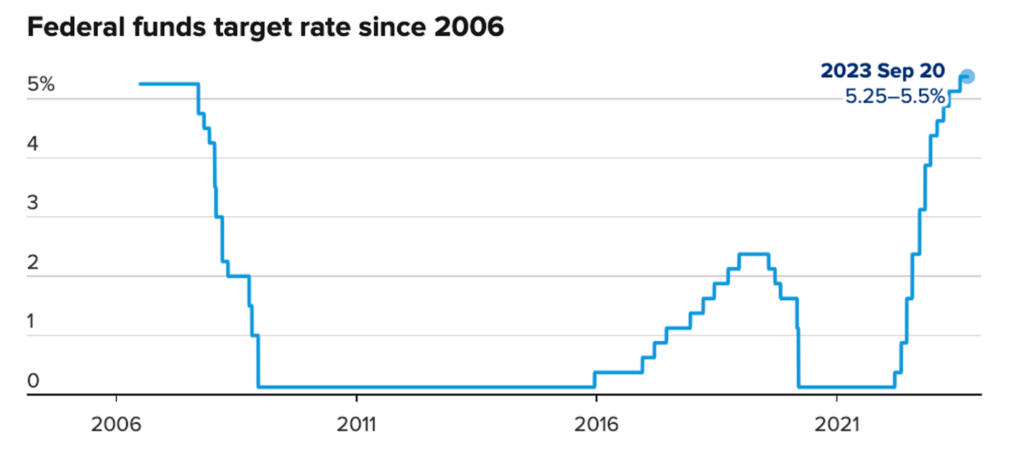

Moving on to the much discussed interest rate, it turns out that the Fed decided to leave the interest rate unchanged in last Wednesday’s announcement. In this meeting, the financial market fully incorporated the idea of no change in the interest rate. This decision keeps the federal funds rate in the range of 5.25% to 5.5%, which is the highest in approximately the last 22 years.

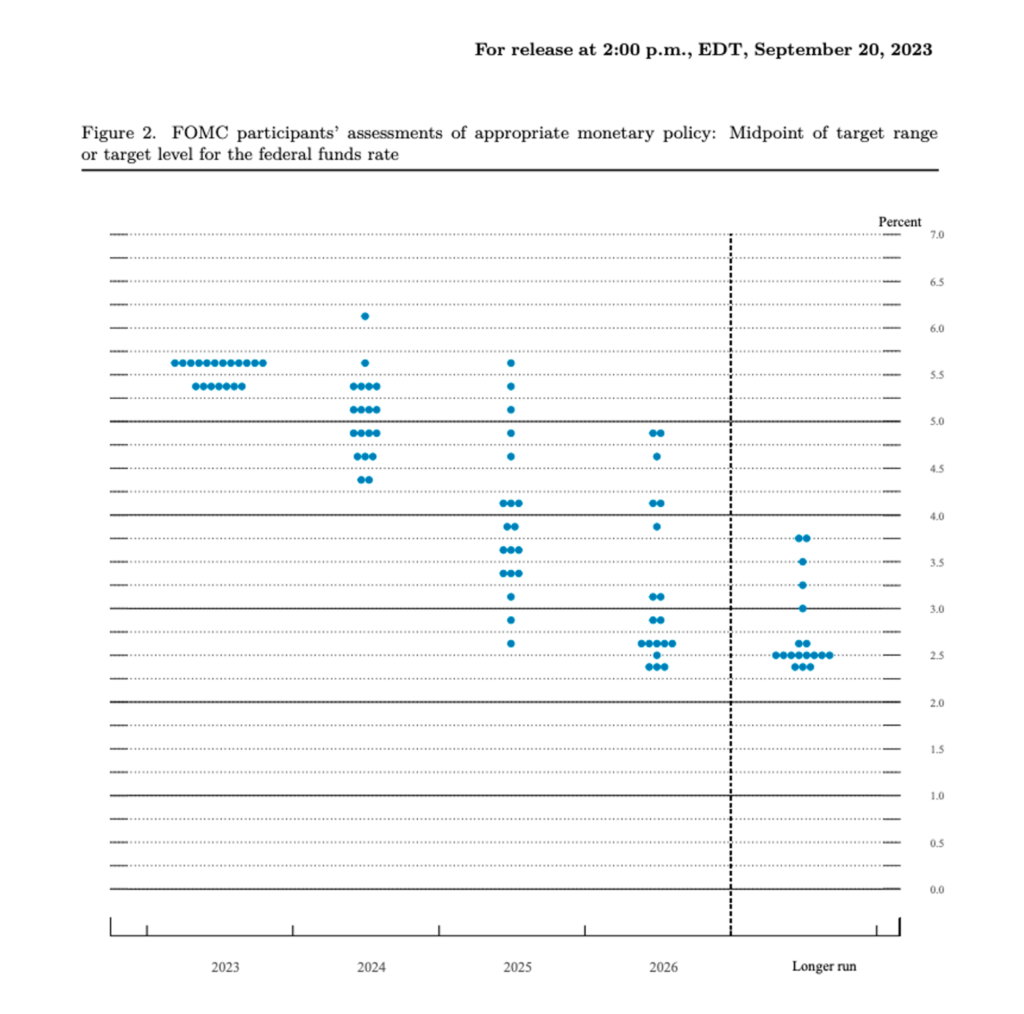

However, the Fed still anticipates a rate hike before the end of 2023 and a slight rate cut in 2024.

Although the decision not to raise interest rates was expected, there is considerable uncertainty about the future actions of the Federal Open Market Committee. Based on the documents released on Wednesday, it appears that the committee is leaning toward tighter monetary policy and a commitment to keeping rates at higher levels for an extended period of time.

This prospect weighed on the financial market, with the S&P 500 down nearly 1% and the Nasdaq Composite down 1.5%. Stocks also fluctuated as the Fed Chair answered questions in a press conference.

The Fed’s dot plot, which shows members’ projections for future interest rates, indicates the likelihood of one more rate hike this year, followed by two rate cuts in 2024. This is a decrease of two cuts from the previous projection made in June. If this forecast is realized, the federal funds rate will be in the range of 5.1%. The dot plot allows members to anonymously express their views on the direction of future interest rates.

At this meeting, twelve participants voted in favor of an additional rate hike, while seven participants voted against. This was one dissenting vote from the June meeting. Projections for the fed funds rate in 2025 were revised higher, with the current median expectation at 3.9%, up from the previous estimate of 3.4%.

Looking further out, members of the Federal Open Market Committee (FOMC) see the federal funds rate at 2.9% in 2026. This rate is above the Fed’s “neutral” rate, which neither stimulates nor restrains economic growth. This is the first time the Committee has provided insight into its expectations for 2026. The long-run neutral rate expectation remains unchanged at 2.5%.

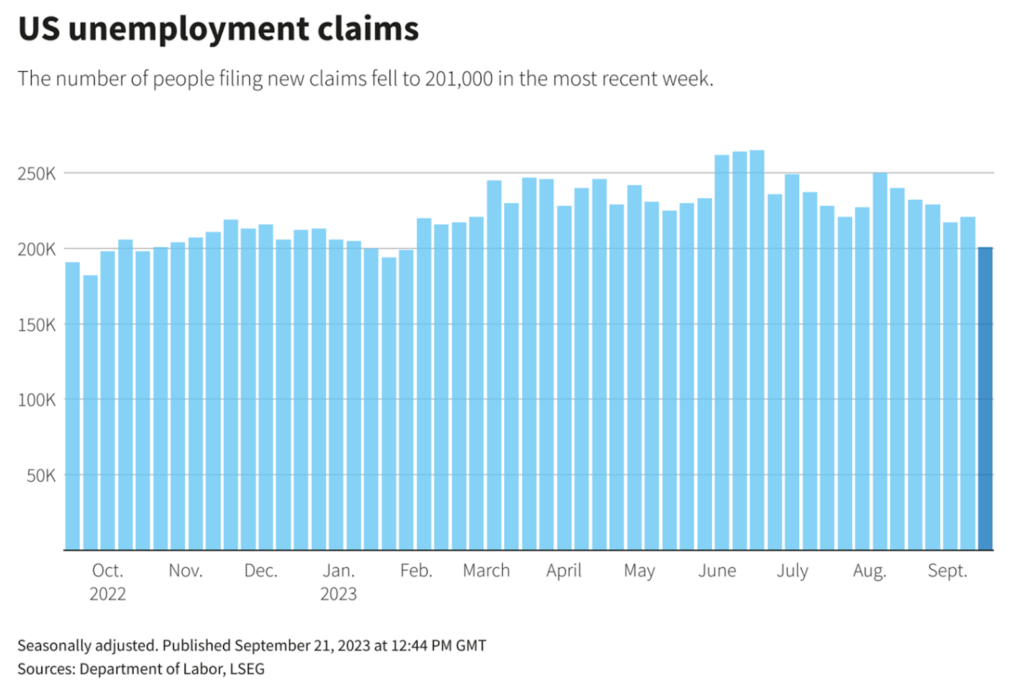

Unemployment Claims

The Labor Department reported that initial claims for state unemployment benefits fell by 20,000 to a total of 201,000, the lowest level since January. Economists surveyed had expected 225,000 claims last week. Meanwhile, continuing claims fell by 21,000 to 1.662 million.

The Labor Department’s report on Thursday offered an upbeat assessment of the employment landscape. The report noted that during the first week of September, the number of people receiving unemployment benefits also fell to levels not seen since January. While demand for labor is showing signs of slowing, overall labor market conditions remain tight, even with higher interest rates.

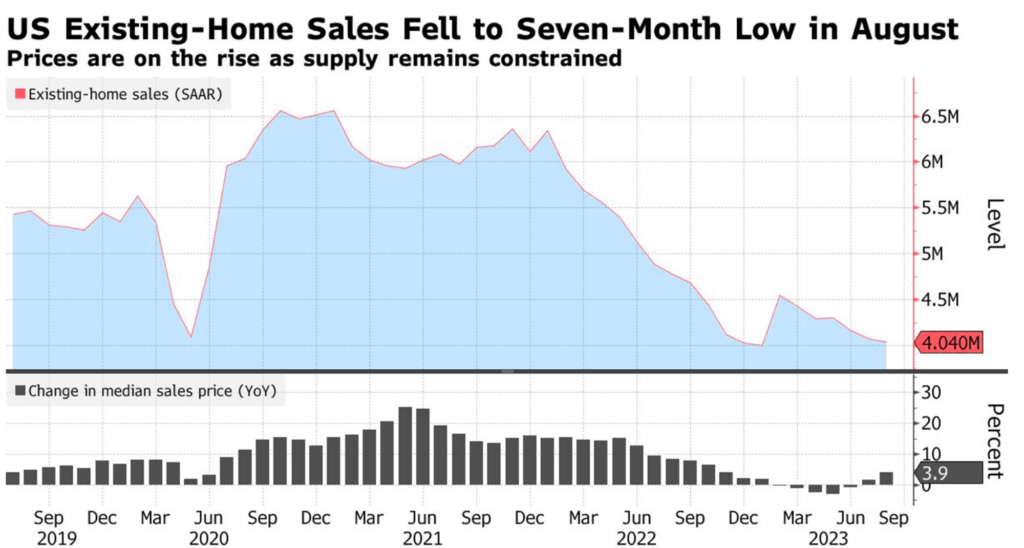

Existing Home Sales

Finally, total data on existing home sales, which includes completed transactions involving single-family homes, townhouses, condominiums and co-ops, fell 0.7% from July to a seasonally adjusted annual rate of 4.04 million in August. Compared to the same period last year, sales are down 15.3%, falling from 4.77 million in August 2022.

BTC & ETH Price Analysis

Last Thursday, Bitcoin experienced a drop below the $27,000 level, which was caused by the market’s reaction to the Fed’s interest rate announcement. Currently, BTC has resistance at the 200-week moving average (MA) at $28,000, which is historically a strong support/resistance level.

Meanwhile, ETH fell below the $1,600 level after failing to break above the 49.00 resistance level, while the Relative Strength Index (RSI) is approaching the oversold territory.

It appears that the bears are targeting the 35.00 support level, which could push ETH down to the $1,575 level.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in a fear phase where they are currently with unrealized profits that are slightly more than losses.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: Relative Strength Index (RSI) indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Stablecoin Tether has invested $420 million in 10,000 H100 GPUs from Nvidia. Northern Data plans to lease the GPUs to AI startups, to meet the trend of miners leveraging the artificial intelligence (AI) boom as GPUs become unviable for Ethereum mining post its energy overhaul in September 2022. This deal positions Northern Data as a strong competitor to the main cloud GPU operators in Europe.

- Injective has launched inEVM, the first Ethereum virtual machine capable of true composability across Cosmos and Solana, developed in partnership with Caldera, an L2 rollup infrastructure platform. InEVM allows Ethereum developers to access Injective’s network and user base, providing high speed, instant transaction finality, a modular toolkit, shared liquidity and composability across the Cosmos IBC universe and Solana. This development follows the launch of Injective’s inSVM, the first integrated Solana Virtual Machine (SVM) rollup solution into the Inter-Blockchain Communication (IBC) ecosystem, allowing Solana developers to migrate their applications to Injective. InEVM aims to democratize the future of finance by promoting decentralization and collaboration between different blockchain networks, with plans to decentralize sequencers and validators using solutions such as Altlayer and Espresso Systems.

News from the Crypto World in the Past Week

- Grayscale has filed an application for a new Ethereum (ETH) futures-based Exchange Traded Fund (ETF) under the Securities Act of 1933. This follows several other filings by various companies and a recent legal victory for Grayscale against the U.S. Securities and Exchange Commission (SEC) in August 2023. The court ruled that the SEC must review Grayscale’s request to convert the Grayscale Bitcoin Trust (GBTC) into a spot bitcoin ETF, a request that was initially denied in June 2022. This development raises hopes in the industry for the approval of an Ethereum futures ETF, following the SEC’s approval of several bitcoin futures ETFs. Following Grayscale’s victory, the price of ETH briefly spiked above $1,700 before stabilizing around $1,634.

- Balancer, an Ethereum-based DeFi protocol, experienced a front-end attack, prompting warnings for users to avoid its website. Although Balancer’s vault is reportedly secure, blockchain security firms estimate that $238,000 in crypto was stolen, with users being prompted to approve malicious contracts that drain their wallets when interacting with the site. This is the second attack on Balancer in a month, with an earlier exploit related to a critical vulnerability resulting in an estimated $2 million loss. The details of the latest attack are still under investigation, and users are urged not to interact with the Balancer user interface until further notice.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Immutable (IMX) +16.40%

- Chainlink +11.60%

- Curve DAO Token +9.92%

- Aave +7.61%

Cryptocurrencies With the Worst Performance

- Axie Infinity -9.36%

- Gala (GALA) -8.23%

- THORChain (RUNE) -8.01%

- Optimism (OP) -7.91%

References

- Suzuki Shillsalot, Grayscale files for new Ethereum futures ETF, ambcrypto, accessed on 23 September 2023.

- Ian Martin, AI’s New Backer: Stablecoin Tether Makes A $420 Million Bet On Cloud GPUs, Forbes, accessed on 23 September 2023.

- Injective Labs, Injective Unveils inEVM: A Groundbreaking Ethereum Rollup for Hyperscaling Multi VM Development, accessed on 23 September 2023.

- Brayden Lindrea, DeFi protocol Balancer’s front end under attack, $238K in crypto stolen, Cointelegraph, accessed on 23 September 2023.

Share

Related Article

See Assets in This Article

0.4%

0.0%

0.0%

0.0%

0.0%

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-