ZK-Rollup vs Optimistic Rollup: A Comparison

Ethereum’s rollup technology has become very popular in the past year. More and more L2 networks are emerging using rollup technology which has been proven to provide much cheaper transaction fees than Ethereum. In addition, technological innovations such as OP Stack and Arbitrum Orbit make launching new rollup networks easier than ever. The rollup sector is also a top choice for the first implementation of zero-knowledge technology. Polygon, zkSync, Starknet, and many other teams are testing their respective versions of zk-rollup. So, how does zk-rollup vs Optimistic rollup compare? Which one is more advanced between the two? This article will explain it in detail.

Article Summary

- 🖥️ Rollup technology is a layer 2 technology that addresses Ethereum’s scalability issues by rolling up multiple transactions into one, thus reducing transaction fees and speeding up transaction finalization.

- There are two types of rollups: Optimistic Rollup (OR) and Zero-Knowledge Rollup (zk-rollup), both of which offer different solutions in terms of speed, security, and ease of implementation.

- 🧠 Both rollup technologies face issues in terms of decentralization and scalability due to the use of centralized sequencers and dependence on Ethereum’s data availability layer.

- ⚖️ Networks with zk-rollup are considered to have greater long-term potential than OR due to their better technology. However, currently, L2 projects with Optimistic rollup are market leaders and some of the most popular.

- ⚠️ In the fourth quarter of 2023, Ethereum plans to issue EIP-4848, one of which contains a proto-danksharing upgrade that will significantly reduce rollup transaction fees.

What is Rollup on Ethereum?

Rollup is one of Ethereum’s scalability solutions that ‘rolls up’ a number of transactions into one on L2 and sends them back to the L1 (Ethereum) network. The technology is a layer 2 Ethereum solution built to reduce transaction fees, speed up transaction finalization, and reduce the load on the Ethereum network.

Rollup technology reduces transaction size by combining approximately 2,000 transactions into a single batch. Once the transactions are combined into one, a validator called a sequencer organizes and sends them back to Ethereum. The L2 becomes the execution environment where all the heavy computation happens. So, transactions are usually 112 bytes on Ethereum and only 12 bytes on rollup.

Read the article about What is Layer-2 at Pintu Academy.

Thus, rollup-type L2 is an option for many projects because it offers cheaper transaction fees while still utilizing Ethereum’s security. Although rollups process transactions and combine them into a single batch, the settlement process still happens on Ethereum. Rollups offer the right combination of security and scalability that many projects find appealing, which is why in the past year there have been so many new L2 projects.

Two Types of Rollups on Ethereum

Optimistic Rollup

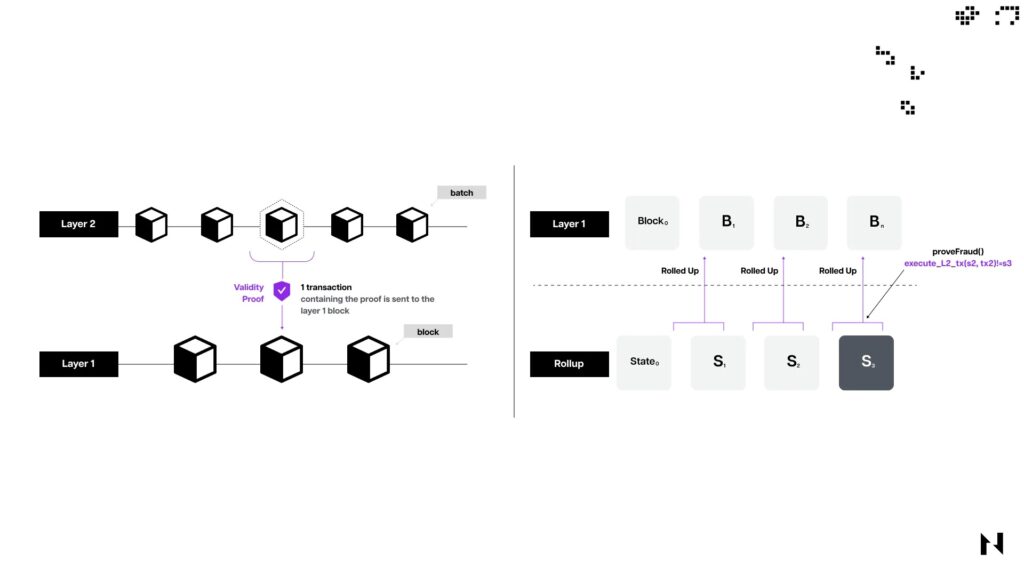

Optimistic Rollup (OR) is a type of rollup that optimistically (hence the name optimistic) assumes all transactions it processes are valid. Each transaction of an optimistic rollup has a fraud-proof that the sequencer can use to check for suspicious, fake, or potentially malicious transactions. If a suspicious transaction is confirmed, the on-chain record will be reverted before the transaction occurs.

Each OR transaction has a seven-day challenge period for the sequencer to check the transaction. While this is good for security, users who want to move assets from L2 to Ethereum have to wait seven days before they can receive their assets. This creates an inconvenience for users and there is currently no alternative solution.

One of the biggest advantages of optimistic rollup is that Ethereum applications can easily migrate to the network. So, DeFi applications on Ethereum like Curve can directly integrate OR L2 without having to rebuild the application.

On the other hand, the main drawback of the OR network is the dependence on the Ethereum data availability layer. So, in the case of Ethereum network congestion, the cost of L2 rollup transactions will increase while speed decreases. Also, the nodes in charge of being sequencers (sending L2 transactions to L1) are still highly centralized. Many teams are developing decentralized sequencers to address this issue.

Some of the most popular L2s with optimistic rollup are Arbitrum, Optimism, Base, and Zora. Arbitrum leads in various metrics such as Total Value Locked (TVL), number of transactions, and daily users.

Recommended read: What is Optimism and What is Arbitrum.

Zero-Knowledge Rollup

A Zero-knowledge Rollup (zk-Rollup) is a rollup that utilizes zero-knowledge (zk) technology to validate transactions. Zk-rollups do this by generating a validity proof called zero-knowledge proof (ZKP) that signifies the validity of a transaction without having to disclose the contents of each transaction. So, Ethereum only needs to validate the ZKP to process an entire batch.

This type of rollup results in even smaller transaction sizes than optimistic rollups. Therefore, the finalization time of zk-rollup transactions is faster than OR. Zk-rollup transactions also do not need to go through a challenge period like OR because ZKP is enough to check the validity of the transaction.

Read about what is zero-knowledge on Pintu Academy.

However, ZKP still has some drawbacks as it is a relatively new technology. First, zk-rollup implementation is very difficult (not many zk systems are compatible with EVM) and requires specialized skills. So, Ethereum applications cannot easily migrate to a zk network. Verifying the ZKP is also computationally intensive and gas costs are currently higher than OR networks. However, many zk-rollup development teams are still developing the technology to lower transaction fees and make it easier to implement zk-compatible applications.

The zk-rollup implementation is also divided into two categories depending on the type of ZKP used: zk-SNARK or zk-STARK. STARK is more sophisticated, resistant to quantum attacks, and has very high scalability, but is very difficult to implement. On the other hand, SNARK is easier to implement and comes with lower gas fees, but has various limitations.

In the past year, projects utilizing zk-rollup have been increasing. Some of the most popular zk-rollup projects are zkSync, Starknet, Scroll, Polygon zkEVM, and Linea. All of these projects are still in the testing phase with zkSync having the highest TVL among the others.

ZK-Rollup vs Optimistic Rollup Comparison

| Aspect | Optimistic Rollup | ZK-Rollup |

|---|---|---|

| Transaction Finality | Faster than Ethereum’s L1 but has a 7-day challenge period if users want to bridge back to L1. | Ver fast transaction finalization because Ethereum only needs to read ZKP and has no challenge period. |

| Security | Utilizing a network of validators processing transactions and issuing fraud proofs. | Employing secure cryptographic Zero-Knowledge Proofs. |

| Scalability | It has low transaction speed and fees hence high scalability. | The zk-rollup technology has the possibility of higher scalability than OR but its implementation is still being developed. |

| Decentralization | Sequencers are still centralized. | Sequencers are still centralized. |

| Transaction Fees | Transaction fees are much lower than Ethereum. | Current zk-rollup transaction fees are still higher than OR because ZKP verification requires complex computation. |

| Ease of Implementation | Easy to implement by new projects and Ethereum applications can directly migrate to L2 OR. | Implementation of zk-rollup is still very difficult due to its complex technology. Also, most zk-rollups are not yet fully compatible with EVM so application migration is still difficult. |

Transaction Finalization/Speed

In theory, zk-rollup should be able to reach finality (completing transactions) faster than an optimistic rollup. Ethereum only needs to read ZKP without verifying all transactions in a batch. Additionally, unlike OR, zk-rollup does not have a 7-day challenge period for asset withdrawal from L2.

However, since the zk-rollup and ZKP technologies are still at an early stage, developers are still looking for ways to make the ZKP verification process fast. Therefore, for now, optimistic rollup still has the upper hand in terms of transaction finality and speed.

Security

In terms of security, zk-rollup and optimistic rollup have relatively equivalent levels of security. The ZKP technology in zk-rollup is more sophisticated and complex but even the L2 network using OR has never been successfully hacked or attacked. Not to mention, both still utilize Ethereum’s security.

Scalability

The zk-rollup technology has a much higher level of scalability than optimistic rollup due to the use of ZKP. The transaction fee of zk-rollup does not scale linearly with the number of transactions in each batch while currently, the transaction fee of optimistic rollup adjusts with the number of transactions. However, the computational power to generate ZKP is still very large and becomes a bottleneck in the scalability of zk-rollup networks.

Beyond the shortcomings of each rollup’s scalability aspect, the speed of both still depends on Ethereum’s data availability (DA) layer. When Ethereum is highly congested, everyone will race to use Ethereum’s DA layer to get the latest block data, including rollup transactions.

Decentralization

Decentralization is the biggest weakness of all current rollup networks. Rollups essentially require nodes that act as sequencers to merge, compile, and send L2 transactions back to Ethereum. Each L2 rollup runs its own sequencer service and this creates a centralized situation where there is a potential weak point for external parties to exploit.

Currently, there are several efforts to develop decentralized sequencers such as a project by EthGlobal.

Transaction Costs

Optimistic rollup networks have transaction costs that increase linearly with the number of transactions per batch. Meanwhile, zk-rollup’s transaction fees are relatively more consistent. However, as explained, the transaction cost of zk-rollup is still expensive compared to OR networks because it is still in the development stage.

However, both will benefit from Ethereum’s next update, EIP-4848, which contains Proto-danksharding. Through EIP-4848, rollup transaction fees will decrease significantly. EIP-4848 plans to launch in the fourth quarter of 2023.

Read about EIP-4848 and Proto-danksharding at Pintu Academy.

Ease of Implementation

Low technology complexity and full compatibility with EVM make optimistic rollup networks very easy to implement by applications and easy to develop for new projects. Moreover, Arbitrum and Optimism have released OP Stack and Arbitrum Orbit which act as a template for projects that want to create new L2 networks. Applications on Ethereum can migrate directly to Optimistic rollup networks easily without making many code changes.

Meanwhile, the relatively new and complex zk technology adds another layer of obstacles for app development teams. Most zk systems have their own programming language that is not compatible with EVM. So, developers like the Polygon team are developing a zk-based system for Ethereum’s execution environment.

The Future of ZK-Rollup and Optimistic Rollup

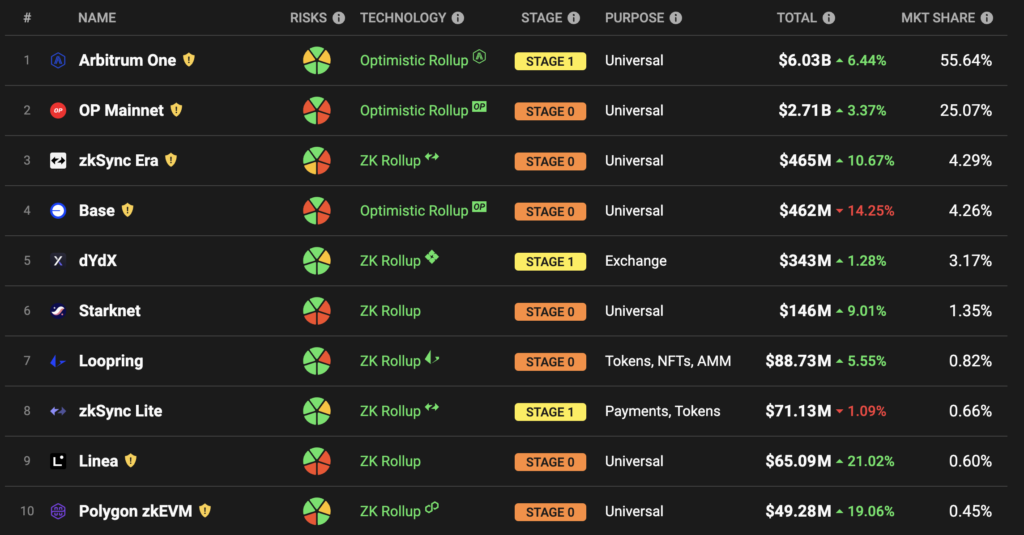

Currently, the Ethereum rollup network sector is highly competitive. According to the L2beat website, there are 22 rollup-based projects with 10 of them using optimistic rollup and the remaining 12 with zk-rollup.

Projects with zk-rollup in particular are in the limelight due to their huge potential. The Ethereum website estimates that zk-rollup can reduce transaction fees by up to 100 times. With the zk trend, Polygon, one of the largest L2, plans a total makeover of its network with Polygon 2.0. This update will make Polygon a zk-based ecosystem.

However, on the other hand, the optimistic rollup sector is having higher adoption. Arbitrum, Base, and Optimism dominate the DeFi sector. Friend.tech, one of the most talked-about decentralized social media apps, was created on top of the Base network. Many innovative DeFi apps like Pendle are also built on the Optimistic rollup network.

So, even though many people already know that zk-rollup clearly has more advanced technology, many projects still choose OR as the foundation of their applications. The ease of building on the optimistic rollup network still trumps zk-rollup’s long-term potential. However, if some zkEVM projects are successfully tested and launched, it is not impossible that many developers will choose to migrate to zk-rollup.

Finally, the EIP-4848 upgrade in the fourth quarter of 2023 will be an important catalyst for the scalability of rollup-based L2 networks. If EIP-4848 successfully fulfills the potential of reducing rollup transaction fees by 90%, more and more users and applications will use L2 on Ethereum. Not to mention, EIP-4848 is also the initial foundation for improving Ethereum’s compatibility with zero-knowledge technology.

Conclusion

Rollup technology has dominated the Ethereum scalability sector in the past year, with many L2 networks adopting this technology to minimize transaction fees while enjoying Ethereum’s security. There are two main types of rollups, Optimistic Rollup (OR) and Zero-Knowledge Rollup (zk-Rollup). OR has the advantage of ease of implementation, allowing Ethereum applications to migrate easily, but has a challenge period of seven days. In contrast, zk-rollup uses Zero-Knowledge Proof for faster transaction validation and does not require a challenge period, although its implementation is more difficult and computationally intensive.

The security of both types of rollups is proven to be equivalent and reliable, but the scalability potential of zk-Rollup is superior. Furthermore, decentralization is a major challenge for both technologies, with some efforts underway to develop decentralized sequencers. Both rollup technologies have great potential to dominate the Ethereum market and attract many new users.

How to Buy Cryptocurrencies on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- “Layer Two and Rollups”, Polkadot Wiki, diakses pada 28 September 2023.

- Donovan Choy, “Layer-2 Rollups: Who’s Winning The Fight To Scale Ethereum?”, Chaindebrief, diakses pada 28 September 2023.

- Huling pag, “Optimistic Rollups”, Ethereum, diakses pada 28 September 2023.

- @jmcook1186, “Zero-Knowledge rollups”, Ethereum, diakses pada 28 September 2023.

- Georgia Weston, “Optimistic Rollups Vs Zero-Knowledge Rollups”, 101 Blockchains, diakses pada 29 September 2023.

- “Optimistic Rollups vs. Zero-Knowledge (ZK) Rollups: How Do They Work?”, Blockchain Council, diakses pada 29 September 2023.

- Ivan Cryptoslav, “Optimistic Rollups vs ZK-Rollups: The Ultimate Comparison”, Coinmarketcap, diakses pada 29 September 2023.

- “Scaling Ethereum”, Ethereum, diakses pada 29 September 2023.

Share