Features

Trading

Learn

ACADEMY CLASS

New to Crypto?

We’re here to help! Master everything about crypto, step by step with our Class.

More

Features

Trading

Learn

ACADEMY CLASS

New to Crypto?

We’re here to help! Master everything about crypto, step by step with our Class.

Leverage Position Risk Amid Fed Rate Decision and Its Impact on Crypto Market

Jakarta, Pintu News – Ahead of the monthly interest rate announcement by the United States central bank (the Fed), crypto traders are reminded to be careful about using high leverage. Michael van de Poppe, founder of MN Trading Capital, said that taking large leveraged positions at a time like this is a “sure recipe for losing money”.

The crypto market is notoriously volatile when it comes to major macroeconomic decisions. After the Fed announced that interest rates would be kept at a range of 4.25% to 4.5%, the price of Bitcoin BTC->Current BTC PriceRp 0Market Cap-Trading Volume-Circulating Supply- experienced only minor movements. This suggests that the market had anticipated the decision from the start.

Powell’s Comments and Unexpected Market Reaction

After Fed Chairman Jerome Powell said that the likelihood of a recession was “not high”, the crypto market immediately showed gains. This was despite a number of independent economists predicting an increased chance of recession.

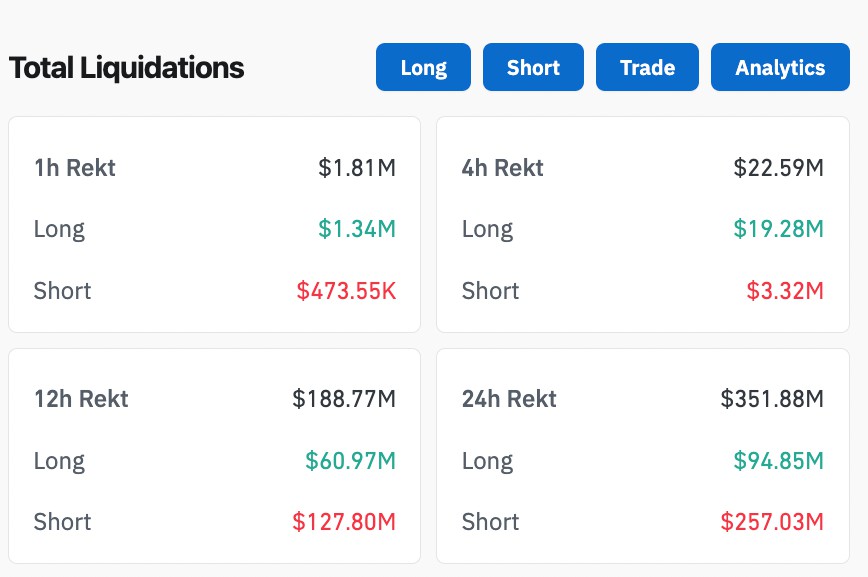

This increase was quite significant and surprised some traders who had previously bet on a price drop. Data from CoinGlass noted that in a span of 12 hours, around $188.77 million (Rp3.078 trillion) was liquidated from the crypto market. Of this amount, $127.80 million (IDR2.084 trillion) came from short positions that lost ground.

Also Read: Bitcoin (BTC) Hasn’t Responded to Wall Street’s Demands, BlackRock Executive Warns

Major Crypto Asset Price Movements Post Announcement

Following Powell’s remarks, the price of Bitcoin (BTC) briefly surged 3.84% in six hours and reached $87,427 (approximately Rp1.425 billion) before correcting back to $85,760 (Rp1.397 billion). Ethereum ETH->Current ETH PriceRp 0Market Cap-Trading Volume-Circulating Supply- also rose by 2.27%, while Ripple XRP->Current XRP PriceRp 0Market Cap-Trading Volume-Circulating Supply- registered a 2.40% gain, adding to its previous rally of 7.50% ahead of the interest rate announcement.

Van de Poppe emphasizes that it is not the formal statement that influences the market, but rather Powell’s words in the press conference. According to him, the direction of the Bitcoin price in the near future is determined more by the nuances of Powell’s comments than the content of the official announcement.

Technical Analysis: Beware of New Positions in the Short Term

The BitcoinHyper trading account also warns that the FOMC-induced price spike made Bitcoin hit a major liquidation level. It advises traders not to rush into new long positions even though BTC prices still have the potential to rise.

Matt Mena, research strategy analyst at 21Shares, adds that while the Fed’s more dovish tone may provide a short-term boost, it does not guarantee a sustained uptrend. He thinks Bitcoin will still be in a consolidation phase until there is a new, stronger catalyst.

Long-term Outlook and Future Interest Rate Scenarios

In his long-term projections, Powell said that the median prediction of FOMC members expects interest rates to be at 3.9% by the end of 2025 and fall to 3.4% by the end of 2026. These forecasts leave room for crypto investors to hope for monetary easing that could boost demand for digital assets.

Nevertheless, analysts agree that caution is warranted. Short-term movements fueled by macro expectations do not always reflect the true direction of the market. With the growing interest in crypto, risk management strategies are key to dealing with high volatility.

Cover

Macroeconomic uncertainty, including interest rate decisions by the Fed, continues to be an important factor influencing cryptocurrency market movements. While some dovish signals from the Fed provide a temporary boost to assets such as Bitcoin and Ethereum, traders are reminded to avoid excessive exposure to leverage, especially in volatile moments such as the run-up to the FOMC. A cautious and analysis-based approach remains the key foundation in dealing with the current crypto market dynamics.

Also Read: This is Arhur Hayes’ BTC Price Prediction Based on April 2025 Fed Rate!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Leveraged crypto positions risk losing big before FOMC, says trader. Accessed March 21, 2025.

- Featured Image: The Street

Latest News

Registered and licensed by BAPPEBTI and Kominfo

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Crypto trading is a high-risk activity. Pintu does not provide investment recommendations or products. Users are required to research crypto assets before making any decisions. All crypto trading decisions are made independently by the user.

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-