3 Altcoins at Risk of Major Liquidation this Week

Jakarta, Pintu News – The crypto market entered the first week of February with an increasingly fierce battle between the bulls (optimists) and the bears (pessimists). Currently, the bears are still in control, but the bulls are starting to see opportunities. This makes price volatility even more complicated. Losses due to liquidation are increasing for both long and short positions.

Why are altcoins like Solana (SOL), Hyperliquid (HYPE), and Tron (TRX) worth watching closely? The following article will review more in detail.

Solana (SOL)

In early February, Solana (SOL) prices fell below $100 due to the negative pressure on the overall market.

Read also: Solana Price Drops 35%: Selling Pressure Begins to Ease, Discount Hunters are in!

The liquidation heatmap for the last 7 days shows that the potential for liquidation comes more from Short positions. Short-term traders using leverage seem to believe that the SOL price can still fall deeper.

However, the price around $100 is the most important support zone for SOL in the last two years. Increasing leverage and capital to go short in key support areas like this usually carries high risks.

Recent analysis from the BeInCrypto website shows a sharp spike in the number of new addresses on the Solana network during January. More than 10 million new addresses were created every day.

In addition, there are several new factors that could potentially drive SOL’s recovery. These include user growth from the launch of meme coins, the expansion of the USD1 stablecoin, and SOL joining the privacy trend through GhostSwap.

The selling pressure caused by the negative market sentiment is now directly confronting Solana’s bullish catalyst in the $100 area. This conflict could trigger a sharp price movement (wick) to the upside or downside. Both Long and Short traders are at risk of liquidation.

Data from CoinGlass suggests that if SOL manages to break back above $113 this week, the potential liquidation of Short positions could reach $500 million. Conversely, if SOL prices continue to weaken to near $86, Long positions could see liquidation losses of over $142 million.

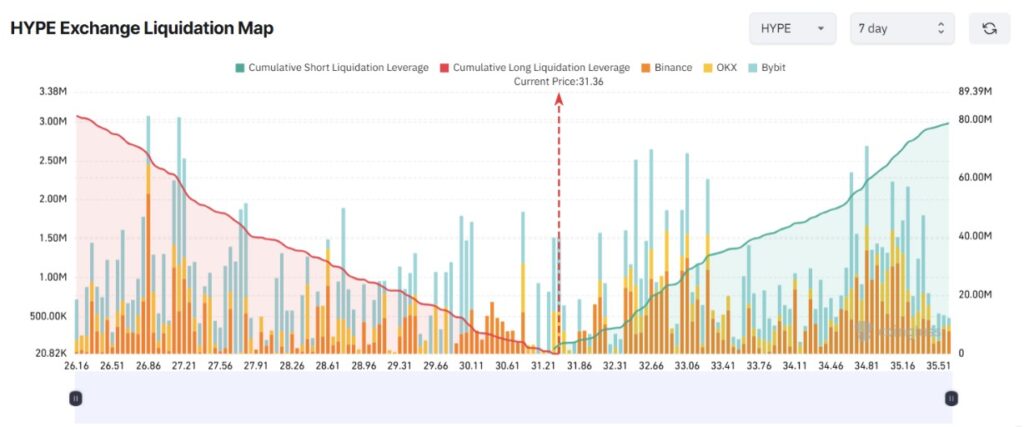

Hyperliquid (HYPE)

Hyperliquid (HYPE) is one of the few altcoins that has been able to sustain a 50% rally since its low point on January 21. Most of the other altcoins printed new lows.

The liquidation map for HYPE shows a fairly balanced state between Long and Short positions. At the current price of around $31, an upward move towards $35.5 could potentially trigger the liquidation of Short positions of around $80 million. Conversely, if prices fall to around $26, Long positions could also see liquidation of $80 million.

HYPE’s ability to rally amid sluggish market trends is already a risk in itself. The report from BeInCrypto also noted a sizable capital outflow, while the market does not yet have sufficient liquidity to support price recovery.

However, HYPE has its own positive catalysts. Among these is the team’s 90% reduction in monthly token allocations. In addition, the demand for trading metal pairs on the Hyperliquid platform also supported the token’s price.

Currently, bulls and bears are neutralizing each other’s strength. In the past four days, HYPE formed consecutive “spinning top” candlestick patterns – patterns that often indicate the potential for large price movements in the near term, which in turn increases the risk of liquidation.

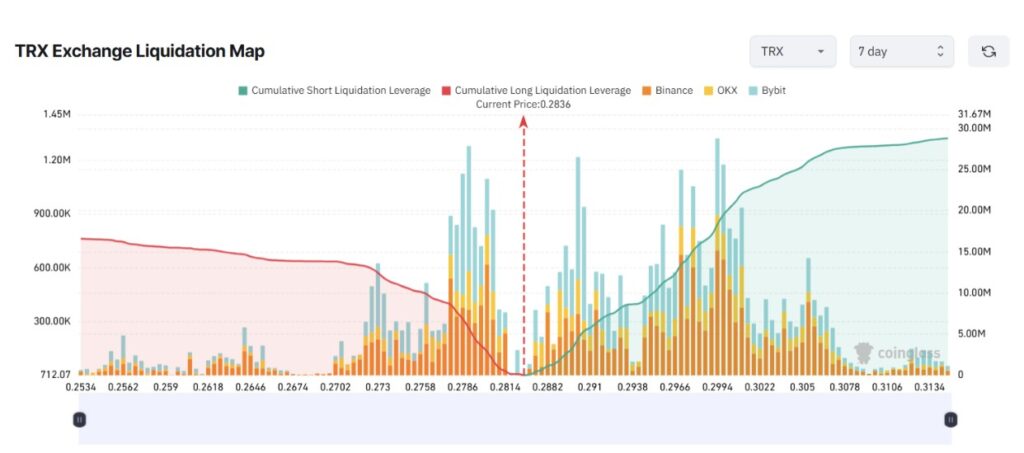

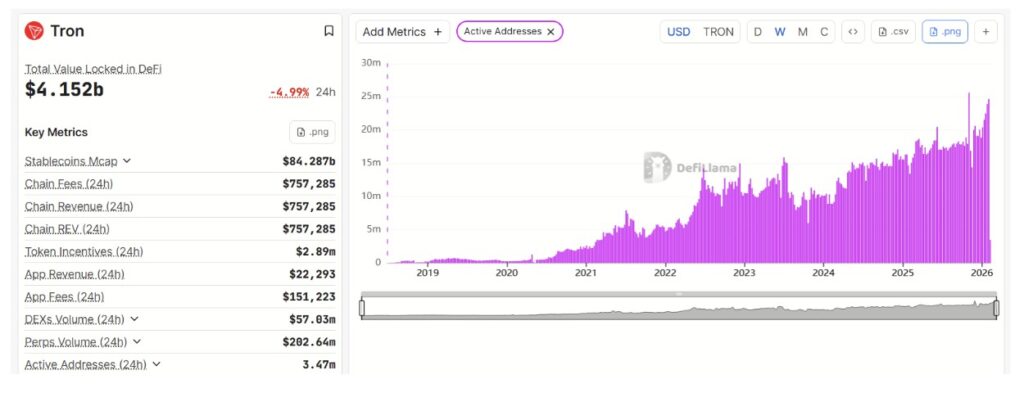

TRON (TRX)

Recently, a woman named Ten Ten (Zeng Ying), who claims to be Justin Sun’s ex-girlfriend, accused Sun of manipulating the TRON (TRX) market in the early stages of the project. She claimed that Sun told employees to open multiple Binance accounts using personal identities to conduct coordinated trading activities.

This issue has the potential to spread negative sentiment among TRX holders, especially amidst the wave of panic selling that has hit the market.

Short-term traders are now betting on a potential further decline. The liquidation heatmap shows that Short positions dominate the liquidation potential. If TRX manages to bounce back and break the $0.31 level, liquidation of Short positions could approach $29 million.

However, there are also signals that demand for TRX remains strong. Tron Inc (NASDAQ: TRON) recently purchased an additional 173,051 TRX tokens at an average price of $0.29. The company’s TRX reserves have now surpassed 679.2 million tokens.

The number of weekly active addresses on the Tron network has also steadily increased over the past few years, and now stands at 24.68 million. This is an indication that interest and demand for TRX remains strong despite the general market weakness.

Short traders may make profits in the short term as long as negative sentiment prevails. However, without a clear profit-taking strategy, those gains can quickly evaporate.

Each of these altcoins-Solana, Hyperliquid, and TRX-has its own narrative and dynamics. However, as market volatility expands, the risk of liquidation increases sharply for both Long and Short traders.

“The total liquidation of the crypto market as a whole has exceeded $5 billion in the past 4 days, becoming the largest wave of liquidation since October 10,” reports The Kobeissi Letter.

As liquidation losses mount, retail investors may run out of capital to continue applying buying pressure. This could potentially push the market into a prolonged phase of stagnation.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Facing Major Liquidation Risks in the First Week of February. Accessed on February 6, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.