5 Crypto Signals to Rise Again: Market Recovers IDR38,600 Trillion, Buy the Dip Reappears

Jakarta, Pintu News – The cryptocurrency market is starting to show signs of recovery after experiencing significant pressure in recent months. Recent data indicates the return of buy the dip sentiment amid rising market capitalization and asset accumulation activity. This condition is an important concern for crypto investors, both beginners and experienced, to understand the direction of the market more objectively.

1. Crypto Market Capitalization Rises to IDR38,600 Trillion

The total capitalization of the crypto market had previously dropped to close to USD2.0 trillion or around IDR33,584 trillion. In the latest development, the value has again increased to above USD2.3 trillion or equivalent to IDR38,622 trillion. This increase indicates an early recovery after the market correction phase.

The increase in market capitalization reflects the re-entry of capital into the cryptocurrency ecosystem. Investors are starting to respond to lower prices as an opportunity, not a threat. Nevertheless, the market is still in a sensitive phase to macro pressures and global sentiment.

Read More: 7 Impacts of Japan’s Political Victory on BTC & Gold Prices

2. Buy the Dip Sentiment Reappears

Buy the dip has once again become the main narrative in the crypto market after the prices of many assets experienced a sharp correction. This strategy refers to the act of buying assets when prices are falling with the expectation of a future recovery. The return of this sentiment shows the psychological shift of investors from defensive to more opportunistic.

However, buying the dip does not always guarantee short-term gains. Investors need to understand that this sentiment usually comes in the early phases of a recovery, which is still prone to volatility. Therefore, understanding cryptocurrency market cycles remains an important factor in decision-making.

3. Stablecoin Flows to Exchanges Begin to Increase

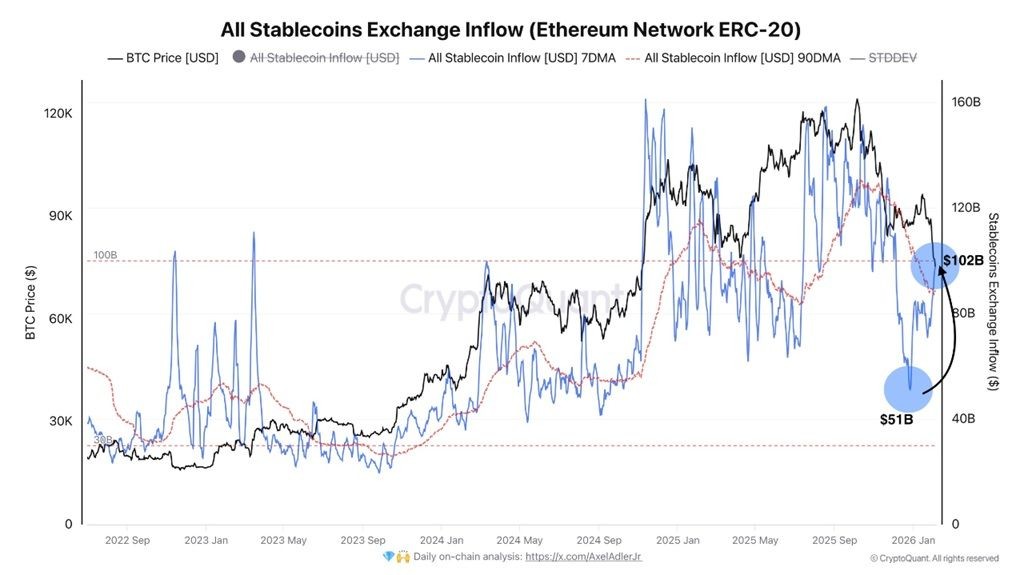

One important indicator of crypto market recovery is the increased flow of stablecoins to exchanges. Stablecoins are often used as ready liquidity to buy cryptocurrency assets. This surge in inflows indicates investors’ readiness to get back into the market.

The increase in stablecoin inflows also reflects a shift from the waiting phase to the execution phase. Investors appear to be preparing capital for asset accumulation, especially after the price correction. Even so, these capital flows still need to be matched by stable trading volumes.

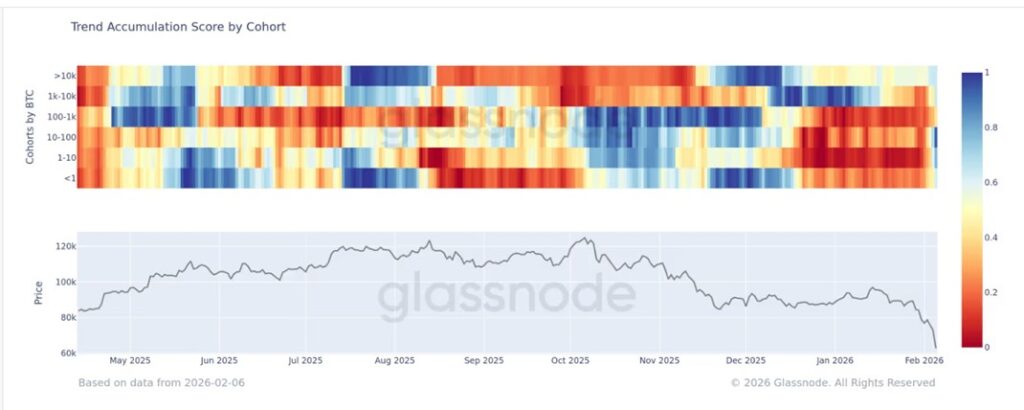

4. Investor Accumulation Seen from On-Chain Data

On-chain data shows that different groups of investors, including small and large wallets, are starting to accumulate. Crypto assets are gradually being withdrawn from exchanges to personal wallets, which is often interpreted as a signal of medium- to long-term holding. This pattern often appears when the market is in a transitional phase.

This accumulation indicates a belief that current valuations are considered more attractive. Investors are no longer focusing on daily movements, but are starting to see the long-term potential of cryptocurrencies. However, this trend still needs to be confirmed by price stability in the near future.

5. Recovery Still Hinges on Key Support Levels

Although signs of recovery are starting to show, the crypto market is still highly dependent on the ability to maintain key support levels. Capitalization above USD2.3 trillion or around IDR38,622 trillion is a crucial area to maintain positive momentum. If this level fails to be maintained, the risk of further correction remains open.

Crypto investors are advised not to rely solely on short-term sentiment. Risk analysis and portfolio management remain necessary in the face of a dynamic cryptocurrency market. With a rational approach, this recovery phase can be understood as part of a broader market cycle.

Also Read: 5 Facts Robert Kiyosaki is Ready to Buy Bitcoin if it Falls to the Level of IDR101 Million

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Nhat Hoang/BeInCrypto. Buy-the-Dip Sentiment Is Returning – How Far Can the Crypto Market Recover? Accessed February 10, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.