How to Use DCA Strategy during Bull Market

Many investors struggle with timing the market during bull market. Some remain on the sidelines, anticipating price drops before making their move, while others hesitate to enter due to significant prior rallies. In such situations, the Dollar Cost Averaging (DCA) strategy can be beneficial. Want to know how to use the DCA strategy during a bull market? Check out the full article below.

Article Summary

- Dollar Cost Averaging (DCA) is an investment strategy where investors buy assets regularly at set intervals. The goal is to invest at an average purchase price rather than a single price point.

- The DCA strategy is not only suitable for beginner investors. Even big institutional investors like MicroStrategy also apply this strategy.

- To utilize the DCA strategy during a bull market, investors are advised to enter the market as early as possible, accumulate when there is a deep retracement, and take profit after the price rallies.

- Pintu offers an Auto DCA or Nabung Rutin feature that makes it easy for investors to implement the DCA strategy during bull markets.

About DCA Strategy

In investing, an old saying is that time in the market beats market timing. This saying assumes that figuring out the right time to enter the market is difficult. It would be easier and effective for investors to stay in the market longer.

The best way to implement time in the market is by doing Dollar Cost Averaging (DCA). So, what is DCA? DCA is an investment strategy where investors buy assets regularly at set time intervals such as daily, weekly, or monthly.

The DCA strategy aims to help investors minimize the impact of crypto asset price volatility because they buy assets at different time intervals. Thus, they invest at an average purchase price rather than investing their assets once at a single price.

You can learn more about the DCA strategy in the following article.

Why DCA Strategy is Popular?

The DCA strategy became popular because it is considered the best strategy for implementing the concept of time in the market. Buying regularly will result in a more favourable average price in the long run. Meanwhile, if you try market timing, there is a possibility that the point that is considered a dip can still go down.

Another factor that makes the DCA strategy popular is its simplicity. Despite its simplicity, it can still provide optimal profit potential. Both beginner and professional investors are suitable for using this strategy. For example, MicroStrategy is one of the major institutions noted to be active in DCA on Bitcoin.

MicroStrategy purchased Bitcoin for the first time on August 11, 2020. They bought 21,454 BTC worth US$250 million. Since then, they have been regularly buying Bitcoin using the DCA method. Their most recent BTC purchase of 3,000 BTC was made between February 15-25, 2024. Currently, MicroStrategy is estimated to hold 193,000 BTC, valued at around US$11 billion.

Another advantage of the DCA strategy is that investors will find it easier to deal with emotional ups and downs due to drastic fluctuations in crypto prices. With various benefits and the potential for long-term profits, it is not surprising that DCA is one of the most popular strategies used.

DCA Strategy During Bull Market

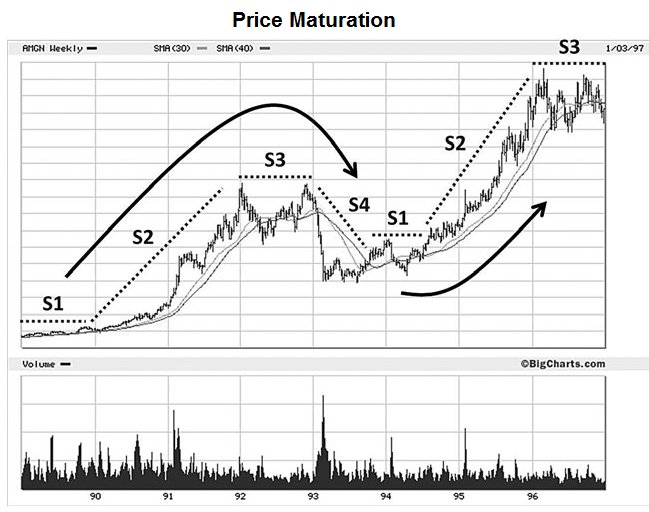

Historical trends show that Bitcoin and the crypto market have price movement cycles. Within that cycle, there are typically four price momentum phases. The first phase (S1) is an accumulation area where crypto prices move sideways due to a lack of news and catalysts. However, this phase offers the greatest profit opportunities.

The second phase (S2) is a trend change. In this phase, after a prolonged sideways trend, prices will rise due to positive catalysts. This phase is the perfect moment to enter and trade.

The third phase (S3) is high volatility. Usually, the news and hype are very high. This phase offers limited profit opportunities. The fourth phase (S4) is the crash. The trend reverses, and the price drops significantly.

Here are five trading tips you can use during a bull market.

1. Enter as Early as Possible

The DCA strategy aims to achieve the lowest average price possible. Therefore, getting in as early as possible is the first step when using this strategy.

The best phase to do DCA is when the market is still in the early S1 or S2 phase. If you regularly do DCA in this phase, the potential profits will be huge when the market enters the late S3 phase. The easiest way to identify the S1 phase is when the crypto market is in the bear market phase.

For example, the S1 phase is when BTC moves in the $15,000-$25,000 range throughout 2022. While entering 2023, BTC began to undergo an uptrend, marking the start of the S2 phase.

2. Buy More Every Time there is a Significant Price Drop

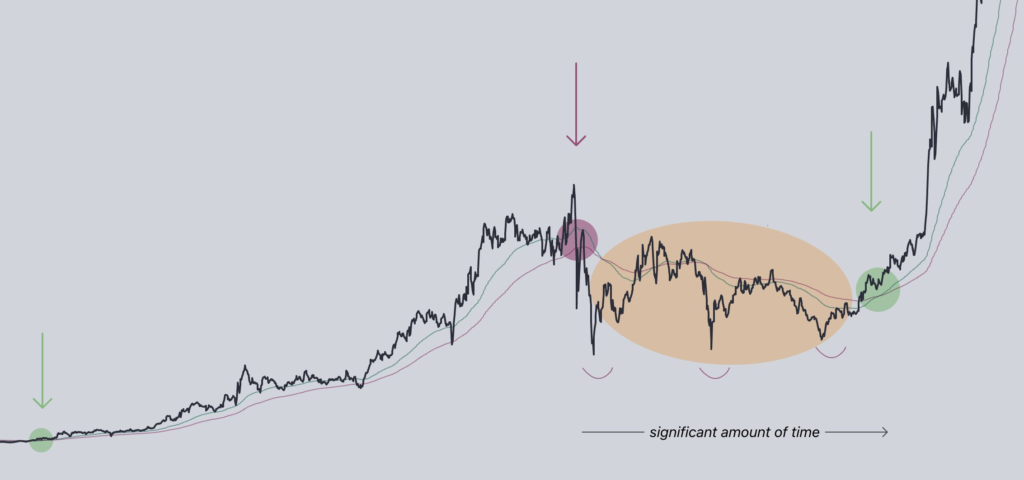

As we know, a positive trend will not last forever. There comes a time when prices will fall to reset their trend in the future. This phase is often called a bullish chop to describe the downtrend phase after a significant price increase.

After a bullish chop, the asset price will move sideways. This is an excellent period to do DCA continuously, for example, daily. You can lower the average price each time you buy when there is a dip.

DCA in a bullish chop phase is a great opportunity to catch an entry when you've missed the initial move. It can also be an opportunity to double down on your spot bags for the next leg up.

3. Don’t Forget to Take Profit

During bull markets, we often forget or are reluctant to take profits. Paper profits are meaningless if we don’t cash them out. Therefore, make sure to take profits when prices have risen sharply.

In taking a profit, each investor has their method. Some take profit when the profit has reached 50%, 75%, 100%, and so on. Some take profit by taking all the capital, leaving the remaining profit for later sale when the crypto price or bull market period has peaked.

One indicator that can be used to measure the bull market’s peak is the number of crypto exchange application downloads. Traders often use the Coinbase App as a benchmark. The increase in Coinbase downloads shows increased interest from retail investors.

In fact, on several occasions, the price of BTC reached ATH at the same time as the Coinbase app, ranked first in the App Store or Google Play Store. This occurred on December 8, 2017, when BTC reached a price of $17,000; May 11, 2021, when BTC reached $58,000; and October 28, 2021, when BTC reached $62,000. Afterwards, BTC underwent a correction and started a bearish phase.

So what about the current situation? At the time of writing, BTC has recorded a new ATH of $72,950. At the same time, the trend of the number of downloads of the Coinbase app has also increased. On January 15, 2024, it ranked 500th out of all apps. On March 12, 2024, it was already ranked 128th.

https://x.com/COINAppRankBot/status/1747106401766256940?s=20

https://x.com/COINAppRankBot/status/1767747412376924531?s=20

Looking at the Coinbase app ranking above, we can see that retail investors have not jumped into the crypto market. Signalling that the bull market has yet to reach its peak.

Use Pintu DCA Feature during Bull Market

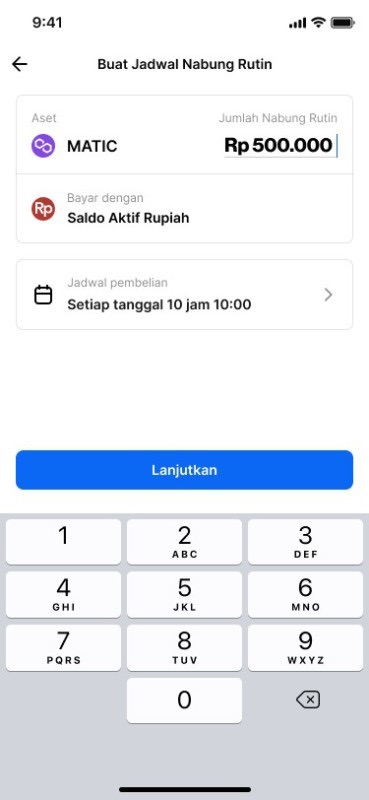

Pintu offers an Auto DCA or Nabung Rutin feature that you can use to simplify and improve your investment experience. With the Auto DCA feature, you can buy crypto assets automatically with a fixed amount at a specified time interval.

You can set a regular investment schedule with daily, weekly, or monthly interval options. Thus, you will automatically acquire crypto assets on the date and time that you have specified.

Here’s how to use the Auto DCA feature:

- Open the Pintu app and click ‘Auto DCA’ or ‘Nabung Rutin’.

- Choose the token that you will use for regular saving.

- Input the amount of rupiah for your regular savings (maximum IDR 40 million).

- Set the purchase schedule (date and time).

- Click ‘Confirm Routine Saving’.

The Auto DCA Pintu feature also comes with DCA Simulation to see how DCA works in specific scenarios without making actual investments. This feature allows you to test your DCA strategy and see its potential results before investing real funds.

With Pintu, your crypto investments become more planned, automated, and aligned with your preferences.

In addition to Auto DCA, Pintu also has a Limit Order feature. Learn how to use it here.

Conclusion

Dollar-cost averaging (DCA) is a popular investment strategy among cryptocurrency investors. This strategy is not limited to retail investors but is also used by institutional investors such as MicroStrategy.

It is best to do DCA when asset prices are dropping significantly for more optimal long-term results. By doing DCA, investors can lower their average purchase price. Pintu offers an Auto DCA or Nabung Rutin feature that makes it easier for investors to apply the DCA strategy consistently.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Adam Hayes, Dollar-Cost Averaging (DCA) Explained With Examples and Considerations, Investopedia, accessed on 11 March 2024.

- Beetcoin, Price momentum can always be divided into 4 stages, accessed on 11 March 2024.

- Crypto Amsterdam, Tips to get in a bull market, X, accessed on 11 March 2024.

- Bread & Butter, Retail metrics for bull market, X, accessed on 11 March 2024.

- ZeroIka, Here is a taking profits technique that will help you lock-in future gains, X, accessed on 11 March 2024.

Share