Investing in FXS: Frax Share Tokenomics and Potential

In January 2023, a lot of crypto assets experience significant rallies. Bitcoin rallied to $24,000 and many altcoins increase by more than 100%. One of them was Frax Finance (FXS). FXS or Frax Share gain the attention of the community with the launch of frxETH, a liquid staking token for Ethereum. Frax Finance successfully creates an ecosystem that benefits both the protocol and FXS holders. In the previous section, we talked about what Frax Finance is and how it works. This article will explain the important role and function of the FXS token and its potential as a crypto investment asset in 2023.

Article Summary

- 🏦 Frax Finance is a stablecoin protocol that offers various financial products on a single platform. Frax aims to create a decentralized financial ecosystem with an economic model that benefits its participants.

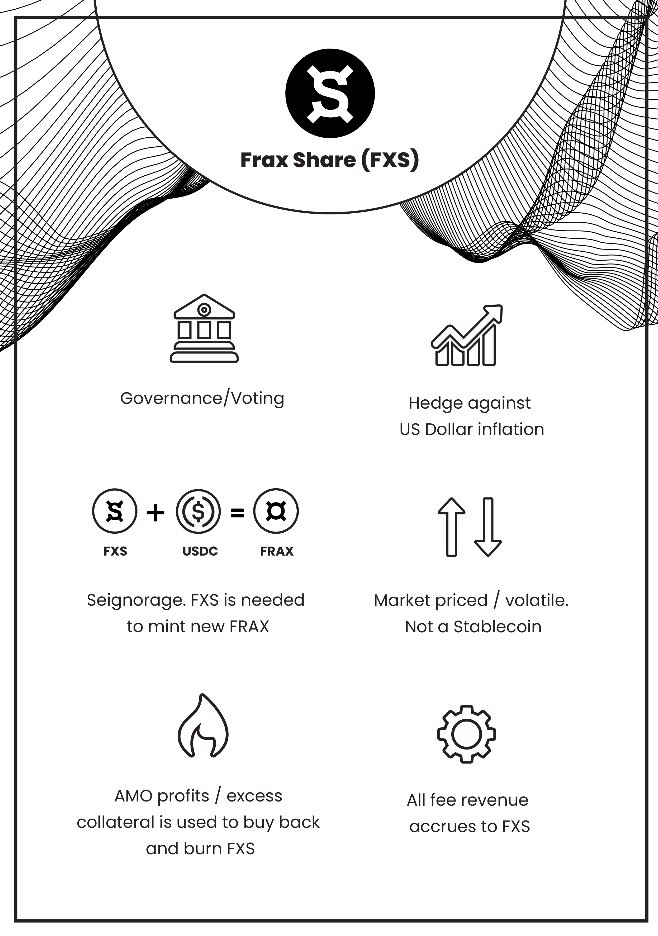

- 🪙 Frax Share or FXS is a utility and governance token whose role is to regulate the burning and minting of FRAX, keep the stability of FRAX, and absorb revenue and excess collateral that enter the Frax ecosystem.

- 🧠 FXS has a maximum token cap of 100 million FXS with a burning mechanism. Currently, there are 74.4 million FXS circulating in the market. FXS has a halving mechanism that cuts FXS emmision every year.

- ⚙️ The design of FXS stands to benefit long term FXS holders who participates in the Frax governance system. FXS owners get all the profits and revenues of Frax Finance through veFXS.

- 💸 The two main ways to gain yield from FXS are to become an FXS liquidity provider on DeFi platforms or to convert FXS into veFXS.

- ⚖️ Fundamentally, Frax Finance and FXS have many advantages over other tokens from the LSD sector. However, many other factors can affect the token price such as the crypto market situation and technical chart.

FXS Tokenomics

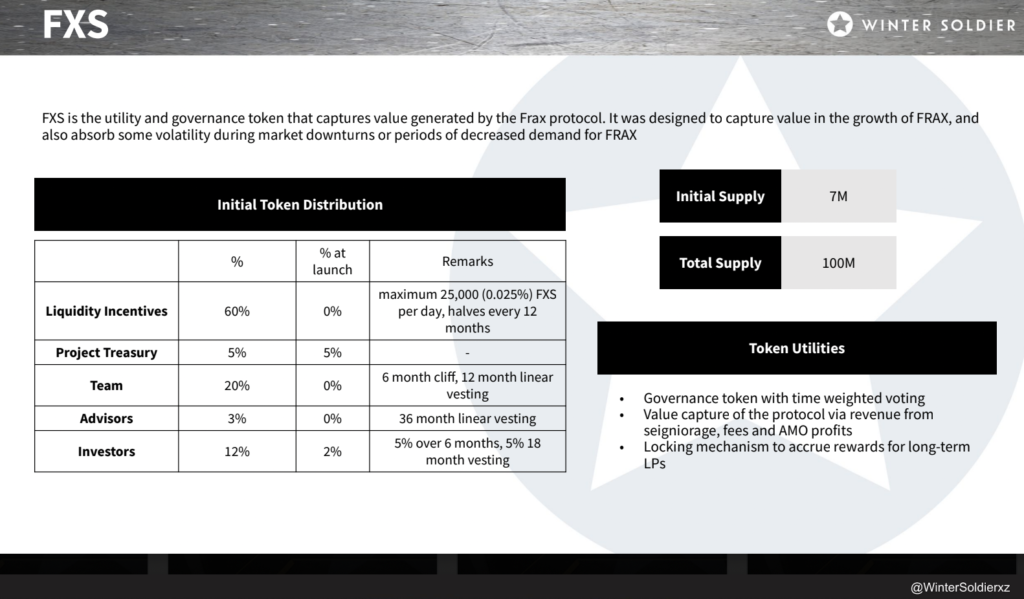

FXS has a token cap of 100 million FXS. Currently, the total supply of FXS is 99.8 million with around 0.17 million FXS already burned by the protocol. Of this total, 74.4 million FXS are circulating in the market. In addition, FXS also has a burning mechanism that could potentially make it deflationary like ETH. Its community can govern all aspects of FXS through a decentralized governance system.

In terms of token distribution, the majority of FXS are allocated to incentive rewards for users and liquidity pools. FXS also has a unique mechanism taken from the Bitcoin model of halving. FXS halving occurs once a year and it cuts the amount of FXS emission from incentive rewards. For example, in 2022 the FXS emission is 12,500 FXS per day and in 2023 this figure is cut to 6,250 FXS.

The role of veFXS in the Frax Finance Ecosystem

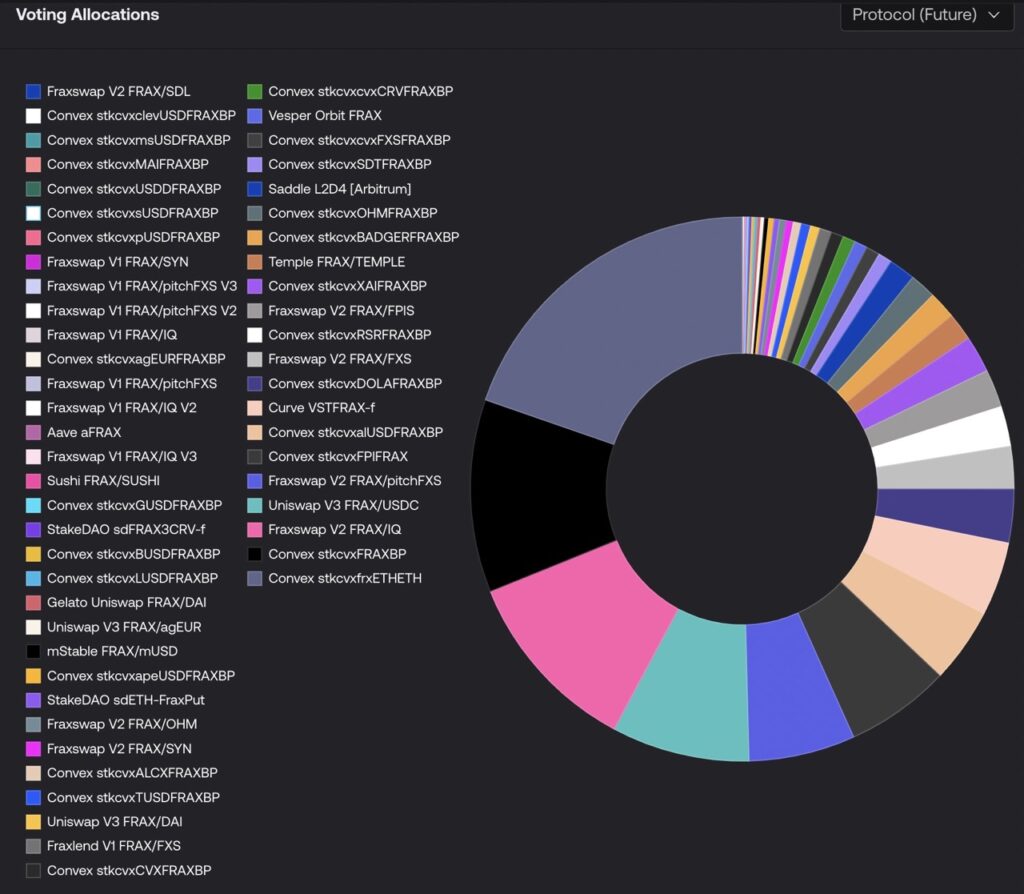

Users who wish to participate in Frax Finance governance must lock FXS into veFXS. So, this is similar to the traditional staking mechanism but it is also for the governance of the protocol. Users can lock FXS and earn veFXS multiplied by the duration of the lock (100 FXS locked for 4 years will earn 400 veFXS). In the Frax governance system, one of the important uses of veFXS is for the gauge system that governs the allocation of FXS emission to each liquidity pool.

As mentioned, veFXS holders will benefit from all Frax products including Fraxswap, Fraxlend, and Frax ETH (veFXS holders get 8% of Frax Finance’s ETH validator profits). So, all veFXS holders will earn protocol income from transaction fees, seigniorage, and AMO profits. Basically, veFXS profits are directly correlated with the growth of Frax Finance.

There are 2 ways to earn profits through frxETH liquid staking: being a liquidity provider on Curve or locking frxETH into sfrxETH to earn yield from Frax Finance ETH validator.

Finally, the FXS1559 Update (taken from Ethereum’s EIP-1559) brings a new policy that benefits veFXS owners. Normally, 50% of Frax protocol profits when conditions are above CR (collateral ratio as explained in the previous Frax articles) are used to buy back FXS and burn it while the remaining 50% goes to veFXS owners. FXS1559 changes this to 100% for veFXS owners. Basically, FXS1559 makes FXS holders get all the profits and revenue of Frax Finance through veFXS.

Frax Finance Roadmap

Sam Kazemian explained that Frax Finance’s long-term goal is to obtain a Federal Reserve Master Account license. The Master Account license will make Frax Finance officially registered in the United States and make FRAX the first decentralized stablecoin to be licensed. It will also make FRAX and FXS attractive to many institutional investors looking for interest and returns.

Frax will likely issue a new stablecoin like frxUSD if it manages to secure the license. However, the uncertainty of the US legal landscape in crypto is a major obstacle.

References

- Research Decks by @wintersoldierxz, accessed on 6 March 2023.

- Frax Finance Co-Founder Sam Kazemian Makes His Case For Stablecoin Maximalism at ETHDenver, Flywheeloutput, accessed on 6 March 2023.

- Why Frax and Curve Are Inevitable w/DeFi Cheetah, Flywheeloutput, accessed on 6 March 2023.

- Frax Proposal: Move 100% of FXS1559 to veFXS Yield, Snapshot, accessed on 6 March 2023.

- Jake Pahor, “Part 9 of my deep dive research series will be on $FXS”, Twitter, accessed on 7 March 2023.

- Thor⚡️Hartvigsen, “Frax Finance has been crushing it lately And with their growing ecosystem of DeFi products, $FXS has a TON of upside in 2023.”, Twitter, accessed on 7 March 2023.

- DeFi Cheetah, “[$FRAX & $DAI] Why are stablecoins of @fraxfinance, @CurveFinance more regulatory-resistant than @MakerDAO?”, Twitter, accessed on 7 March 2023.

Share