Get to Know GMX.io: Decentralized Spot and Perpetual Exchange

The explosive growth of the cryptocurrency industry can be largely attributed to the rise of decentralized financing and the proliferation of crypto asset exchanges. These platforms have made it easier than ever for individuals to trade and manage their digital assets, opening up a world of financial opportunities that were previously only available through traditional banks. With the help of platforms like GMX, users can now enjoy the best of both worlds, leveraging the power of DeFi and the convenience of a sophisticated exchange platform to optimize their assets and maximize their returns.

This is what makes GMX the choice platform for many traders lately. So, what is GMX? how does GMX work? And what is its potential? Let’s find out more in this article!

block-heading joli-heading" id="article-summary">Article Summary

- ⛓ GMX is a decentralized exchange that facilitates spot and perpetual trading, and is currently active on the Arbitrum and Avalanche networks.

- 👨🏻💻 If you previously had to use a centralized exchange (CEX) to do leverage trading, with GMX, you can do leverage trading directly from your crypto wallet, and have complete control over the assets you own.

- 💡 Trading on GMX is supported by a multi-asset liquidity pool mechanism that generates rewards from market making, swap fees, leverage trading, and so on. These rewards are given to liquidity providers who store their assets on GMX.

- 📊 Based on data from Messari, GMX is among the top 10 protocols with the largest fee income, along with Uniswap, OpenSea, Lido, and others.

- 🔎 Like other exchanges, GMX has a utility and governance that is also called GMX. GMX token holders can use it to vote on proposals and also for staking to get rewards.

So, What is GMX?

The crypto industry and decentralized finance (DeFi) technology continue to develop, offering various financial facility innovations. One of them is GMX, a decentralized exchange (DEX) that not only serves spot swaps but also perpetual futures, a feature previously only available on centralized exchanges (CEX). GMX users can do perpetual futures trading with leverage of up to 30x, similar to what is available on CEX.

Unlike CEX, GMX users can independently manage their assets without having to “deposit” their assets. This is made possible by the decentralized nature of GMX, which allows users to manage their own assets through smart contracts on the blockchain. This means that users have full control over their assets and can trade them directly from their own wallets.

In addition to perpetual futures trading, GMX also provides other features such as token staking and liquidity provision, which can generate rewards for users. GMX currently supports trading on the Arbitrum and Avalanche networks, and plans to expand to other networks in the future.

Spot trading in crypto is the activity of buying or selling crypto assets directly, on the spot or at the current market price. Meanwhile futures trading is a type of agreement between a buyer and a seller to trade assets at a certain price and date in the future. This allows buyers and sellers to lock in cryptocurrency prices and protect themselves from potential price fluctuations. Futures trading is more complex than spot trading, and is often used by traders looking to hedge their positions or speculate on the future price of cryptocurrencies.

How Does GMX Work?

To facilitate crypto asset trading on its platform, GMX uses a shared liquidity mechanism called GLP, which is GMX’s liquidity provider token. The mechanism used by GMX is different from other DEXs which generally use Automated Market Maker (AMM) to provide liquidity on the platform. To understand more about how GMX and GLP work, here is an explanation.

GLP mechanism

Currently, the liquidity pool at GMX consists of 8 assets on Arbitrum (ETH, WBTC, LINK, UNI, USDC, USDT, DAI, and FRAX), and four assets on Avalanche (AVAX, WETH, WBTC and USDC). When a user invests any of the available assets into the GMX platform, he will earn GLP tokens. And as a reward for saving their assets on GMX, users will get a share of the fees charged to users of the platform.

As explained above, the GLP token consists of an index of assets used by the exchange for swaps and leverage trading. GLP can be printed or minted by depositing any index asset available on Avalanche or Arbitrum, or burned to redeem any index asset. It is important to note that GLP on Arbitrum and Avalanche cannot be operated on and cannot be transferred between the two chains.

The fees for minting, burning, and exchanging GLP will differ based on whether the activity raises or decreases the asset balance. For example, if the index has a high proportion of ETH and a low percentage of USDC, the next action that increases the amount of ETH owned by the index will be charged a high cost, while the action that reduces the amount of ETH owned by the index will be charged a low fee.

In the context of DEX, liquidity refers to the availability of buy and sell orders for a particular crypto asset on the exchange. If an exchange has high liquidity for a particular crypto asset, it means that there are many buy and sell orders available, and it is easy to trade the crypto asset without significantly affecting its price. On the other hand, if an exchange has low liquidity for a particular crypto asset, it means that there are only a few buy and sell orders available, and it may be difficult to trade the asset without significantly affecting its price.

GMX Features

Apart from being a liquidity provider and taking advantage of GLP, users can of course take advantage of various trading features which are the advantages of this platform. In addition, as in most other exchange platforms, users can also stake GMX tokens. The following is an explanation of each of these features and also how to use GMX.

1. Perpetual Trading

As previously explained, GMX has a feature that allows its users to do perpetual trading directly from each user’s cryptowallet. Trader can go long or short on the pair of their choice, with leverage ranging between 1.1x and 30.5x. Market limit, take-profit, and stop-loss orders are available, with a position opening/closing fee of 0.1%.

Users can access the trading page by clicking the “Trade” button on the GMX site’s home page. To begin trading with leverage, users can choose “Long” or “Short” depending on their desire, with the loan amount adjusted via the “Leverage Slider” given below.

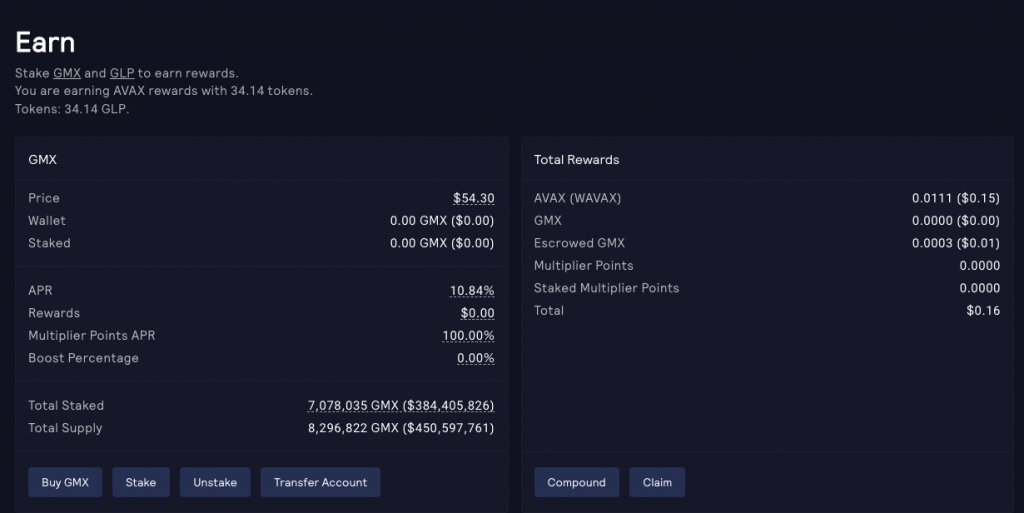

2. Staking

In addition to trading, GMX also has a staking feature that crypto investors can use to get passive income. To generate rewards from staking GMX tokens, users must connect their wallet to the GMX platform and click the “Earn” page, then select “Stake”.

After confirming on-chain transactions in the wallet, users will start earning 30% of all GMX protocol fees, plus the esGMX incentive. Users can see the amount of staking reward received in the “Total Rewards” section. Users can also click the “Compound” button to stake the rewards received to maximize revenue.

GMX’s Tokenomics

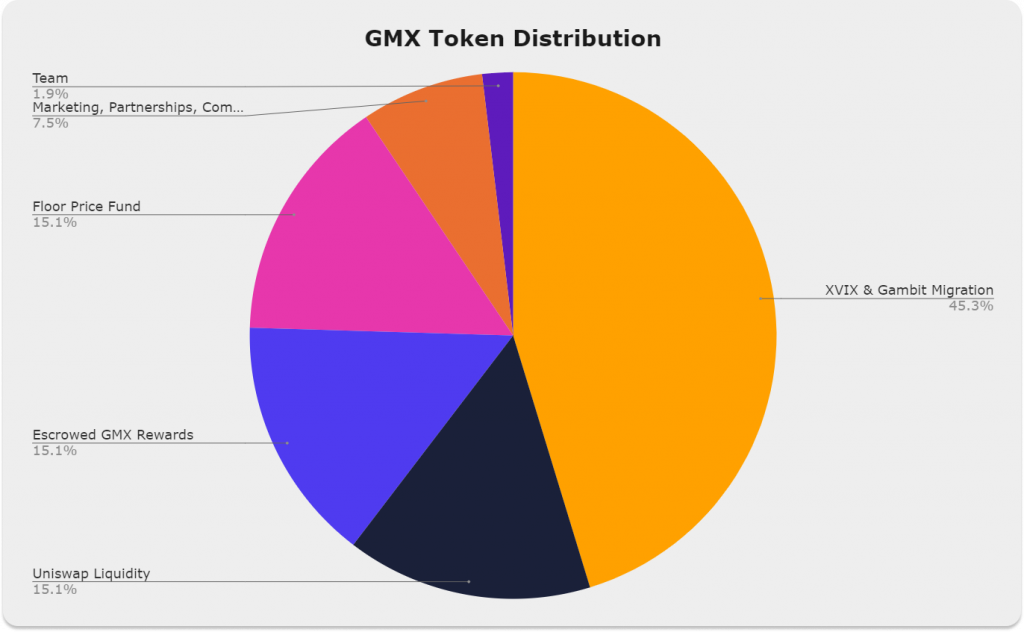

GMX has an estimated maximum supply of 13.25 million tokens, which can be increased if more product launches and liquidity mining are required. But that will depend on voting governance tokens. Below is a split chart of how the 13.25 million GMX tokens will be distributed.

As seen in the pie chart above, one of the unique features of GMX is a feature called the Floor Price Fund, which is a collection of money used to support the GMX token value. These funds are backed by ETH and GLP tokens.

Quoted from the Tokenomics page on the GMX website, the Floor Price Fund comes from two sources: fees from the GMX/ETH trading pair and also from Olympus bonds. If the GMX market price drops below a certain level, the Floor Price Fund can be used to buy back and burn GMX tokens. This means GMX tokens purchased are removed from circulation, and can help support the value of the remaining GMX tokens and prevent the price from falling further. This is known as a “buyback and burn” and is meant to help maintain a minimum “base price” for GMX.

GMX as Investment

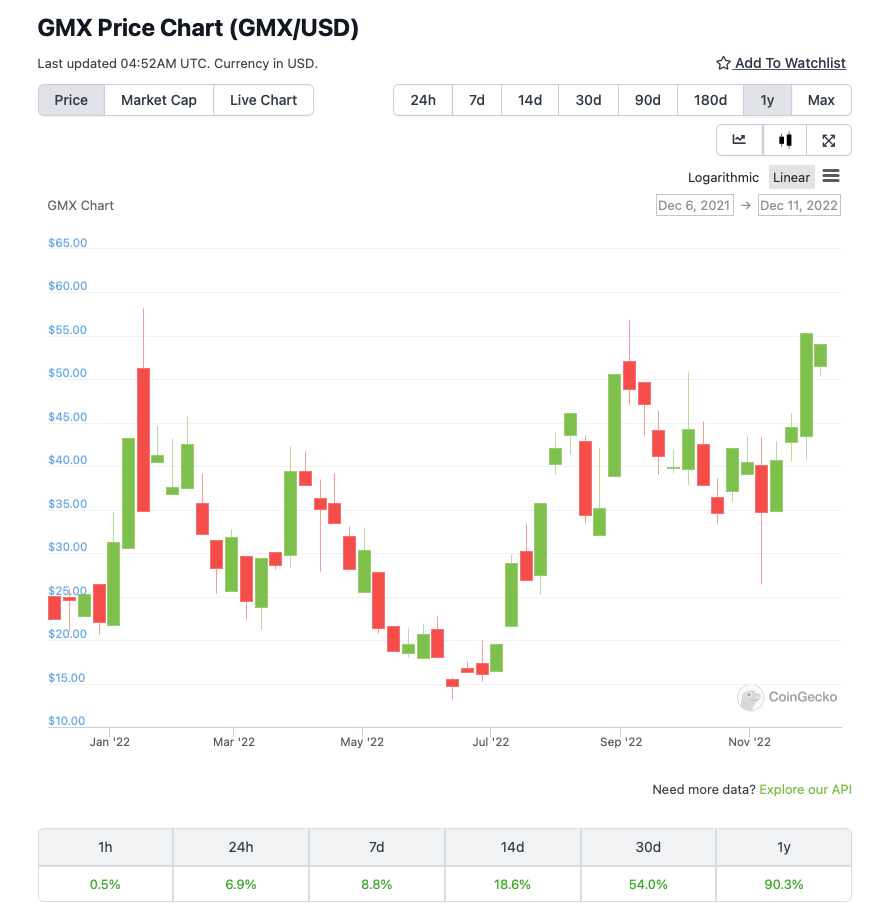

GMX was released in September 2021 at a price of around 15 US dollars. Shortly after its launch, the cryptocurrency market entered a bear market with substantially lower market capitalisation. The industry’s overall market value plummeted by 69% between November 2021 and mid-June 2022. (from USD 3 trillion to USD 920 billion). At the same time, the GMX token price decreased by 58%, which was not too badly (from 33 US dollars to 14 US dollars).

GMX recently received great support from investors and traders. This support boosted the price of its token with a price increase from around 14 US dollars in mid-June 2022 to the current price of 51 US dollars on December 9 (at the time of writing) — an increase by 264%.

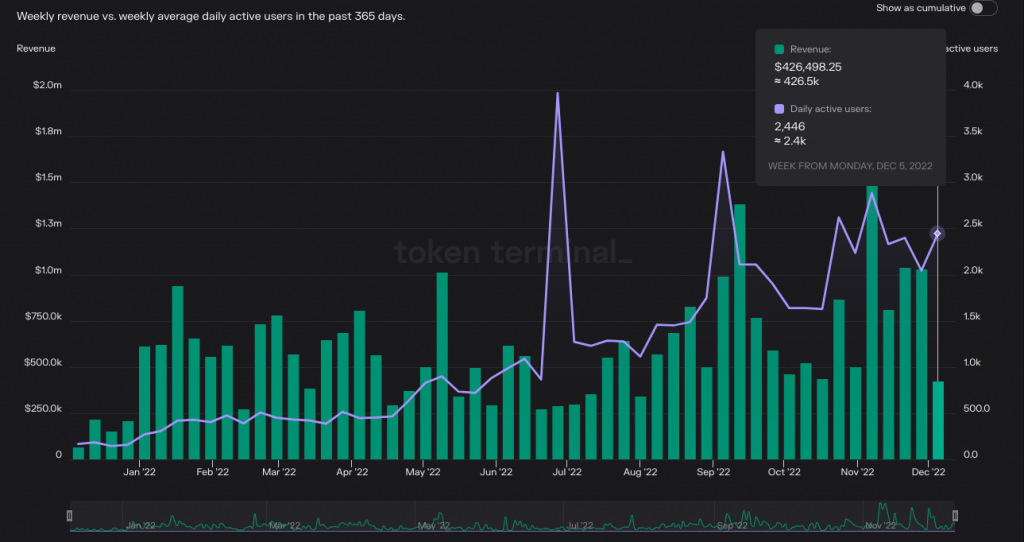

Referring to the data from Token Terminal below, it can be seen that the platform recorded an increase in daily user revenue since Q4 this year.

In conclusion, GMX basically makes it easy for anyone to invest and trade with sophisticated features but with a transparent mechanism—an advantage of a decentralized platform. This is what makes it attractive to many investors and traders following the FTX incident in November 2022, where the funds of millions of investors stored on the platform disappeared.

However, it should also be noted that GMX is run by an anonymous team whose identity has not been revealed as of now. Therefore, make sure you strategize and do research before investing in crypto products including GMX.

How to Buy GMX at Pintu

You can start investing in GMX tokens by buying them in the Pintu app. Here’s how to buy GMX on the Pintu app:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for the GMX token.

- Click buy and fill in the amount you want.

- Now you have GMX tokens!

In addition, Pintu application is compatible with various popular digital wallets, such as Metamask, to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Besides making transactions, in Pintu, you can also learn more about crypto through various Pintu Academy articles that are updated weekly!

All Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Kunal Goel, GMX: Spotting the Future, Messari, accessed on November 8, 2022

- Big Smokey, 3 reasons why DeFi investors should always look before leaping, Cointelegraph, accessed on November 15, 2022

- Chase Devens, Analyzing Leading Protocol Fundamentals, Messari, accessed on December 8, 2022

- Tokenomics, GMX, accessed on December 8, 2022

- 0xKepler, GMX Deep Dive, Mirror, accessed on December 8, 2022

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-