What is Injective Protocol (INJ)?

In 2022, the collapse of FTX Crypto Exchange prompted crypto users to seek safer storage options for their crypto assets, leading them to Decentralized Exchanges (DEX). The reason behind this is because DEXs offer a higher level of security as well as greater control over their investments. To build DEXs and multiple decentralized applications (dApps) in a fast, comprehensive, and fully decentralized manner, developers can utilize Injective Protocol. This article will explain what Injective Protocol is, how it works, and its advantages.

Article Summary

- 🔗 Injective Protocol is a blockchain created for building dApps, specifically cross-chain derivatives trading on Layer-1 networks such as Cosmos, Ethereum, and several other blockchains.

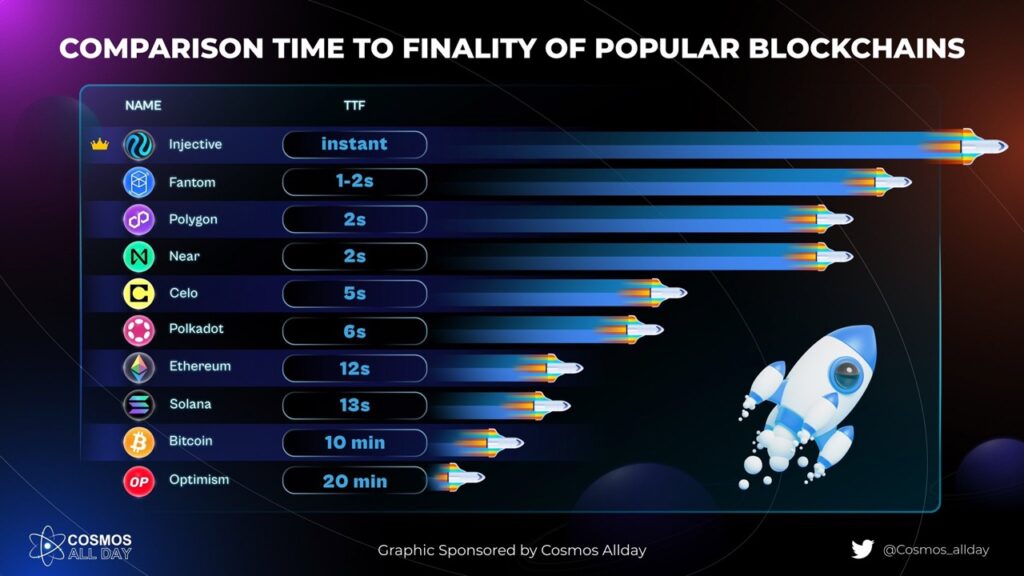

- ⚡ The Injective Chain (the name of the Injective Protocol blockchain) uses a Tendermint-based consensus mechanism and utilizes the Cosmos-SDK. The main advantage of choosing Tendermint consensus is that it makes Injective highly scalable (10,000+ TPS).

- 🏦 Injective Protocol allows external developers to build various spot, perpetual, futures, and options markets in a permissionless trading ecosystem. In addition, users can trade assets in the Injective Protocol ecosystem without gas fees.

- 🪙 INJ is Injective Protocol’s native token as a utility and governance token.

What is Injective Protocol (INJ)?

Injective Protocol is a blockchain created to build dApps, especially for financial products like cross-chain derivatives trading on Layer-1 networks such as Cosmos, Ethereum, and several other blockchains. Some of the dApps that run on this platform include Helix, Frontrunner, Astropox, and others. In addition, the platform is equipped with a utility and governance token, INJ.

One of the key features of the Injective Protocol is the decentralized exchange (DEX) which leverages cutting-edge technological innovations by providing speed, security and a high degree of decentralization. The Injective DEX offers advanced features to facilitate cross-chain trading, such as margin trading, derivatives, Forex, synthetics, and futures trading.

Due to its unique technical architecture, the Injective DEX utilizes a shared order book infrastructure to access cross-chain spot and derivatives markets without gas fees. Furthermore, Astroport’s integration into the Injective ecosystem in March 2023 makes the platform supports Automated Market Maker (AMM) systems like any other DEX.

Read also What is Automated Market Makers (AMM)?

Injective allows external developers to build a variety of spot, perpetual, futures, and options markets in a permissionless trading ecosystem. All aspects of the exchange infrastructure are decentralized, including the order book, matching engine, liquidation engine, oracles, and insurance fund. Injective's primitive order book offers advanced features such as stop loss, take profit, reduce-only, post-only, and liquidity incentives.

Injective launched its mainnet called Canonical Chain in November 2021. Canonical Chain brings several updates, such as unrestricted asset transfer and trading, new products, interoperability upgrades, and improved INJ tokenomics.

block-heading joli-heading" id="who-founded-injective-protocol">Who Founded Injective Protocol?

Injective Protocol was founded by Eric Chen and Albert Chon in 2018 based in New York, United States. Eric Chen, the CEO of Injective Protocol, has experience in finance. Previously, he joined as a Venture Partner at Innovating Capital, which became one of Injective Protocol’s investors. While Albert Chon, CTO of Injective Protocol, was a Software Development Engineer at Amazon before starting Injective Protocol.

Injective Protocol has a team of experts in blockchain technology and finance. The team members consist of full-stack developers, Solidity and Golang developers, finance specialists, and marketing researchers. In addition, the team is supported by blockchain advisors such as Sandeep Nailwal, founder of Matic, and Andreas Weigend, former chief scientist at Amazon.

Additionally, Injective is backed by Pantera Capital, Jump Crypto, Binance, Hashed, BH Digital, Cadenza Ventures, CMS, QCP Capital, Mark Cuban, BlockTower, and others. The platform raised 40 million US dollars in a new round on August 10, 2022. It brings Injective’s total funding to 56.7 million US dollars to date.

How Injective Protocol Works?

Injective Protocol consists of four main components as follows:

- Injective Chain

- Injective’s bridge smart contracts

- Injective API nodes

- Injective dApps

Injective Chain

Injective Chain is the name of Injective Protocol blockchain specifically built for creating DeFi applications. It operates by utilizing Tendermint consensus, which ensures that all transactions are validated securely and efficiently. The platform also uses the Cosmos-SDK.

The primary advantage of using this Tendermint consensus is that it makes Injective highly scalable (10,000+ TPS). The platform also uses a unique layer-2 scaling solution, enabling fast and cheap asset trading.

Read also What is Layer 2 Crypto?

Injective Bridge

This platform offers a decentralized cross-chain bridging infrastructure to enable communication and asset transfer between blockchain networks. Injective has a bridge that connects Ethereum to the Injective Chain.

The Injective bridging system ensures that the transfer of assets between the two chains is secure and decentralized. This bridge system supports not only ERC-20 token transfer but also arbitrary data transmission, which enables new cross-chain execution and smart contract interoperability with Ethereum.

Injective API

Injective APIs (Application Programming Interfaces) are nodes (or servers) in the Injective Protocol network with two primary purposes.

- Data Layer: The nodes collect and store Injective chain data in real time. The API node indexes this data and provides an API external clients that can use to interact with the blockchain data. These APIs are designed to be high-performance and have low latency, which means they can provide quick responses to any requests made by clients.

- Transaction Relay Service Provider: The nodes can help users send transactions without paying gas fees. In Injective networks, users can delegate gas fees to other parties who can pay those fees on their behalf. This mechanism is called fee delegation, and Injective API nodes can facilitate this process by relaying transactions on behalf of users.

Injective dApps

Injective is a decentralized protocol. There are many dApps currently built on top of Injective. The most widely used dApps built on top of Injective is decentralized exchanges (DEX). Helix is one of the most popular dApps built on top of Injective.

Besides DEX, Injective also supports several other dApps. These include dApps for insurance, prediction markets, binary options, and others. These applications allow users to access decentralized financial services without relying on a central authority.

Thus, Injective Protocol allows users to participate in decentralized finance applications through a blockchain network, such as creating DeFi applications, connecting blockchain networks, buying and selling crypto assets, and confirming transactions by validators.

The characteristics of Injective Protocol are fully decentralized, permissionless, censorship-resistant, community property, and scalable.

Read also Introduction to DApps and Smart Contract Technologies.

Advantages of Injective Protocol

Optimizing Decentralized Financial System

Injective provides a fully decentralized order book and AMM. With Injective Protocol, developers can create DeFi applications such as exchanges and prediction markets without building infrastructure from scratch.

Interoperability

Injective can facilitate cross-chain transactions across Ethereum, Moonbeam, and IBC-enabled chains like CosmosHub, and Wormhole-integrated chains like Solana, Avalanche, and more. This interoperability enables seamless cross-chain transactions, meaning tokens and assets can transfer between different blockchain networks without issues.

Building dApps with CosmWasm

Injective supports CosmWasm, a smart contract platform built for the Cosmos ecosystem. It means that developers can use smart contracts to support their applications on Injective. In addition, CosmWasm-compatible smart contracts can be easily migrated to Injective.

Ethereum and IBC-Compatible Tokens

Injective supports the launch of Ethereum and IBC-compatible tokens. It means that tokens launched on Injective can be exposed to multiple networks by default. It opens up opportunities for developers and users to access a broader market.

Experienced Platform Developers

Injective has experienced and intuitive developers with a development environment with Rust and Golang programming languages. It allows developers to create robust and innovative DeFi applications with ease.

Injective Protocol implements a Verifiable Delay Function (VDF) to ensure no front-running on the order book. Front-running is the use of bots to monitor the order book. These bots can jump the order queue by copying the same offer from a user, causing the user to miss out on the offer.

Conclusion

Injective Protocol is a blockchain specifically designed for building dApps. With its technology, Injective can eliminate front-running, improve liquidity and order execution, and reduce trading costs.

Injective Protocol is pioneering a new decentralized economy by leveraging technological innovation to ease, accelerate, and decentralized trading. With the potential to transform the financial industry, the platform offers access to crypto assets more securely and efficiently, making it attractive to users who want to participate in crypto asset trading in a decentralized market.

How to Buy INJ Token on Pintu?

You can start investing in INJ by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for INJ.

- Click buy and fill in the amount you want.

- Now you have ID as an asset!

In addition, Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn more crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Injective Protocol Team, About Injective, Injective Protocol, accessed 17 April 2023.

- Hasan Furkan Gok, Injective: An Interoperable Exchange Infrastructure Protocol for DeFi Markets, Messari, accessed 17 April 2023.

- Steve Walters, [Injective Protocol Review: Next Gen Synthetic Dex](https://www.coinbureau.com/review/injective-protocol-inj/#:~:text=The Injective Protocol is a,ensure no front-running occurs.), Coin Bureau, accessed 17 April 2023.

- Eric Chen, Injective Protocol (INJ): A Cross-Chain Trading Powerhouse, Cryptopedia, accessed 17 April 2023.

- Binance Team, Injective (INJ), Binance Research, accessed 17 April 2023.

- Injective Labs, Astroport Mainnet Launches on Injective, Medium, accessed 17 April 2023.

Share