Chainlink’s CCIP vs LayerZero: Which One is Better?

One of the most important infrastructures in the crypto industry today is the cross-chain bridge. Bridge is a technology that allows the transfer of assets from one blockchain to another such as from Ethereum to Solana or Ethereum to Arbitrum. This technology is essential for creating connectivity between multiple blockchain ecosystems. Ironically, bridge technology is one of the biggest weaknesses of the crypto industry. In recent years, there have been hundreds of millions of dollars in hacks such as the Ronin Bridge and Wormhole Bridge. That’s why more advanced cross-chain technologies like LayerZero and Chainlink’s CCIP are so important. So, how does LayerZero vs CCIP technology compare? Which one is better? This article will explore it in detail.

Article Summary

- 🌉 Cross-chain bridge technology is essential in the crypto industry to support liquidity and connectivity between various blockchains. However, it is vulnerable to hacking and attacks.

- 📱 LayerZero and Chainlink’s CCIP are more advanced cross-chain technology solutions that offer modular architecture.

- ⚙️ CCIP, which is still in the testing phase, has security advantages and has the advantage of using Chainlink’s proven infrastructure.

- 0️⃣ LayerZero, meanwhile, offers higher transaction speeds and has more interoperability options between multiple blockchains.

- ⚖️ The choice between LayerZero and CCIP comes down to aspects such as security, speed, and interoperability, depending on the needs of the application or service that will use it.

About the Importance of Cross-Chain Protocols

Cross-chain protocols have become increasingly important in recent years. With the DeFi industry growing, the need for unifying liquidity is becoming greater. The cryptocurrency industry needs technology that can connect liquidity between multiple blockchain ecosystems.

A bridge protocol is a protocol that connects one blockchain to another. Usually, the mechanism for transferring assets is lock and mint. The user assets are locked on the source blockchain and minted with the same value on the destination blockchain. In this case, the assets on the destination blockchain will usually be minted in a wrapped token format such as wBTC (wrapped BTC) or wETH.

The Nomad, Wormhole, and BNB Bridge hacking cases occurred because attackers managed to find fatal flaws in the smart contracts of the bridges. The Nomad case mainly occurred due to negligence during smart contract upgrades. Meanwhile, the Wormhole and BNB Bridge cases occurred because hackers cheated the system by creating fake transactions worth hundreds of millions of dollars that were deemed valid by the bridge.

Finally, Axie Infinity’s Ronin hack case happened due to the negligence of the development team. Of the nine validators responsible for the Ronin Bridge, to transfer assets you only need approval from five validators. Hackers manage to control four Sky Mavis (Axie Infinity team) validators through phishing. Then, hackers acquired another validator (AxieDAO) due to the Sky Mavis team’s forgetting to revoke the whitelist access for AxieDAO. The Ronin Bridge hack once again emphasizes the importance of decentralization on critical infrastructure such as cross-chain protocols.

What is CCIP Chainlink?

CCIP or Cross-Chain Interoperability Protocol is a cross-chain messaging protocol built on the Chainlink infrastructure. The CCIP protocol can send all kinds of messages including data, assets, and smart contract instructions to all Chainlink-enabled blockchains. However, CCIP is currently in the early testing phase and only supports seven blockchains, including Ethereum and L2s such as Base and Optimism.

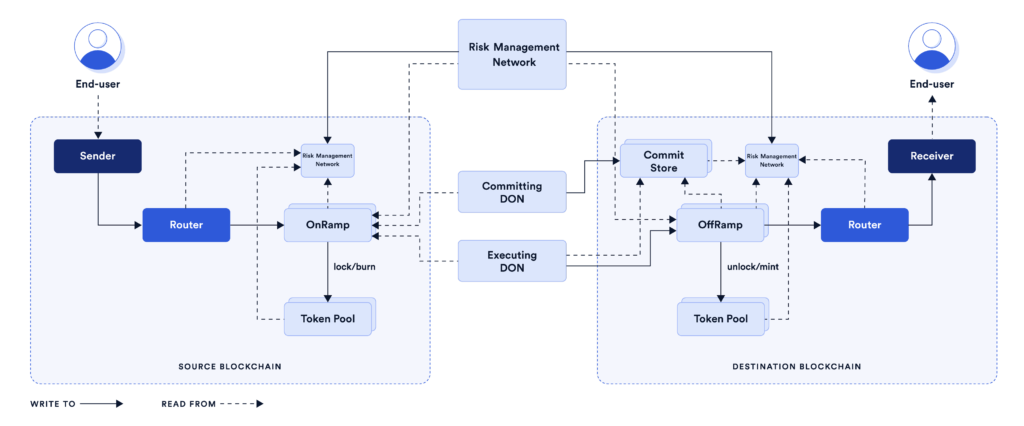

As shown in the image above, CCIP’s infrastructure has three important components: the DON (Decentralized Oracle Network), the Risk Management Network (RMN), and CCIP’s suite of smart contracts (token pool, OnRamp, OffRamp, router, and commit store).

See Pintu Academy’s article on what Chainlink CCIP is and why it is important.

The CCIP protocol is built on top of Chainlink’s DON, consisting of approximately 989 nodes. DON has been running for more than 3 years and is now a pillar of the DeFi industry. In CCIP, DONs are in charge of validating and forwarding cross-chain transactions from the source blockchain to the destination blockchain. Furthermore, DON communicates with the various CCIP smart contracts installed on the blockchain to ensure the data is correct.

DON or Decentralized Oracle Network is a network of nodes that act as oracles. Oracles are in charge of connecting off-chain data to the blockchain such as displaying price data.

As a security-first protocol, CCIP also has a network of independent nodes called RMN. The RMN contains independent off-chain nodes whose job is to examine each transaction and give bless or curse instructions. If the number of risk management nodes that give the bless command is sufficient, it means that the information is valid and will be processed. Conversely, a curse means that the RMN detects a potentially dangerous anomaly.

In addition to opening up many new possibilities by facilitating cross-chain data movement, CCIP ensures that bridge hacks will not occur. CCIP is also modular where the components of CCIP can be modified and changed.

What is LayerZero?

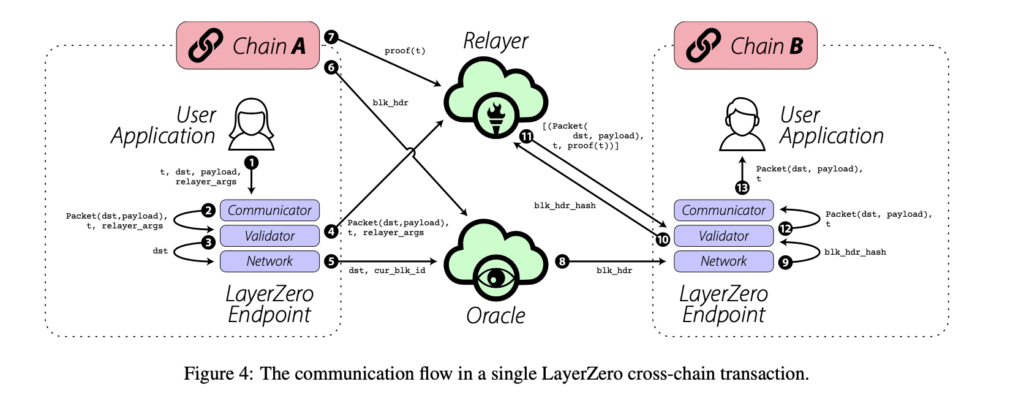

LayerZero is a cross-chain messaging protocol that facilitates interactions between smart contracts across different blockchains. LayerZero consists of three main components, the relayer, Oracle, and Endpoints. Furthermore, LayerZero has been integrated with 26 blockchains and dozens of applications.

In addition to being a cross-chain data transmission protocol, LayerZero can also be the foundation for creating decentralized applications that are simultaneously connected to multiple blockchains. The first application using LayerZero is Stargate Finance, an omnichain DeFi liquidity application that also acts as a bridge between various blockchains.

Just like Chainlink’s CCIP, LayerZero also uses a series of smart contracts and off-chain components to ensure cross-chain transactions. LZ’s off-chain components are relayers and oracles that verify and check the data from the source blockchain to the destination.

Read more: What is LayerZero and why is it important?

Relayers and oracles are independent and can be defined by the application. LZ provides both relayer and oracle services, but applications can also choose any combination of relayer and oracle. An important note about relayer and oracle is that they should be independent and separate to reduce the risk of them colluding to perform hacking and attacks.

CCIP vs LayerZero Technology Comparison

| Components | Chainlink’s CCIP | LayerZero |

|---|---|---|

| Asset Transfer Method | Lock and mint or burn and mint | Lock and mint or burn and mint |

| Interoperability | Specific Chainlink cross-chain lanes | All blockchains with LZ Endpoints |

| Protocol Architecture | Modular | Modular |

| Security | DON with 989+ nodes | Using LZ standard or Outsource |

| Speed | Depends on the destination blockchain | Depends on both interacting blockchains |

| Ease of Implementation | Relatively easy | Relatively easy |

| Value-Added | Facilitates movement of non-blockchain data to the blockchain | Ominchain tokens (OFT and ONFT) |

- Asset Transfer Methods: LayerZero and Chainlink both give each blockchain the freedom to use either lock and mint or burn and mint cross-chain transfer methods. This flexibility is important as each crypto asset blockchain has a different code implementation.

- Interoperability: All blockchains with LZ endpoints can use its cross-chain protocol. In theory, Chainlink should also be able to do the same since it utilizes smart contracts. However, CCIP is still in the testing phase so we can’t judge it yet.

- Protocol Architecture: LayerZero and CCIP both have a modular architecture that allows for modification and swapping of each of its components. The modularity of these protocols is also important for security because if one component fails or is attacked, the other components still work.

- Security: When it comes to security, Chainlink’s CCIP has the advantage of having a proven infrastructure. In the last three years, Chainlink’s DON network has never been attacked or hacked. Meanwhile, the resilience and security of LayerZero’s network is untested. One of the security concerns of LZ is the relayer and oracle. The security level of each LZ protocol will vary greatly, depending on the combination of relayer and oracle chosen and this is potentially dangerous.

- Speed: Through Stargate Finance, LayerZero has proven that its cross-chain technology can settle transactions quickly. CCIP on the other hand has yet to go through real-world testing in processing transactions. Nonetheless, the two should be able to compete as the speed depends on the two interacting blockchains when asset transfer occurs. LayerZero has an advantage because its smart contracts client is very lightweight.

- Ease of Implementation: LayerZero and CCIP are very easy to implement as they both only require a set of smart contracts. In the case of LZ, if the development team wants to quickly deploy, they will use the default relayer and oracles provided by LZ. In theory, CCIP will be easier to implement as the infrastructure is already in place.

- Value-Added: The value-added category is specifically for discussing the additional value that CCIP and LayerZero provide. For LZ, the value-added comes in the form of OFT and ONFT tokens, which are omnichain tokens that simultaneously exist across all LayerZero-connected blockchains. Meanwhile, CCIP’s value add is to a bridge between the blockchain and non-blockchain world, which is crucial for DeFi applications that target traditional financial institutions or want to leverage physical asset tokenization (RWA).

The Future of CCIP and LayerZero

From the previous comparison, it can be seen that CCIP has a higher level of security with Chainlink’s years of proven infrastructure. However, LayerZero has also been proven to work well in the last year since its inception. In addition, LZ also has a first movers’ advantage because it has been releasing cross-chain protocol products since 2022 while CCIP is still in testing.

In addition, these two cross-chain protocols are likely to be the next big thing. LayerZero has just announced a partnership with Google Cloud for more secure and reliable relayer services. Although this cooperation also raises the question of decentralization, we cannot deny that Google Cloud is an industry giant. The partnership shows Google’s confidence in LayerZero’s technology and products.

On the other hand, Chainlink is taking a different route, working with Swift, the world’s financial transaction organization containing many international banks. Swift and Chainlink are testing CCIP’s ability to move tokenized assets across multiple public and private blockchains. Based on its testing, Swift is satisfied with CCIP’s interoperability capabilities.

Chainlink’s CCIP will be a strong competitor to LayerZero, which has already established a foothold in hundreds of crypto protocols. With a proven infrastructure, CCIP has clear advantages over LZ. However, in the crypto world, better does not translate into more success. LayerZero has an incentivized airdrop that will happen in the next few months, and this has attracted hundreds of millions of dollars to its ecosystem. The competition in the interoperability protocol space will benefit many industry players by creating a more resilient infrastructure that can withstand attacks and hacks.

Conclusion

Cross-chain bridge technology in the crypto industry is crucial in supporting liquidity and interconnectivity between various blockchains. While bridges are one of the key innovations in this space, they also expose the industry to significant security risks, such as the Ronin Bridge and Wormhole Bridge hacks. LayerZero and CCIP Chainlink are two sophisticated cross-chain technologies. Both offer modular architectures and flexible asset transfer methods, but CCIP has the advantage in terms of security as it has been tested, while LayerZero offers higher speed and interoperability. Both protocols have their advantages, and the choice of which one to use will depend on the needs of each application.

How to Buy Cryptocurrency on the Pintu App

ou can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice

References

- “CCIP Architecture and Billing | Chainlink Documentation“, Chainlink, accessed on 14 September 2023.

- Chase Devens, “Inside LayerZero’s $120M Series B Raise: How the Cross-Chain Protocol is Driving Growth“, Messari, accessed on 14 September 2023.

- @chainlinkgod, “Good breakdown of the fundamental design differences between Layer Zero and CCIP When an app is using CCIP for cross-chain messaging / token transfers,” Twitter, accessed on 14 September 2023.

- Pickle and Aylo, “Layer 0 Wars: LayerZero vs Chainlink’s CCIP“, Alpha Please Substack, accessed on 15 September 2023.

- Fil, “Cosmos IBC, LayerZero, and Chainlink CCIP. Comparing Cross-Chain“, Mirror.xyz, accessed on 15 September 2023.

- Donghyun Kang, “Can Chainlink’s CCIP Become a Standard Over LayerZero?“, Xangle, accessed on 15 September 2023.

Share